This article appears in Summit Journal (Fall 2020) | Download PDF

It isn’t easy to accept the world as it is right now, but if we do, we will likely thrive.

Many believe the world will return to normal once the pandemic passes. Whether it’s the economy, political systems, or the future of real estate demand, predictions of future trends are usually influenced by hidden assumptions that a post-COVID world will mostly look like the pre-COVID world. It’s described blithely as the “new normal.” An emotional need for a return to the past may obscure understanding of what is happening right now.

What is happening? Current thinking has consolidated around the idea of an acceleration of pre-COVID trends. That appears to be accurate. Online shopping, virtual work, movement from high-priced gateway cities to less expensive secondary markets, evolving supply chains, and new technologies are emerging trends that have been around for some time.

But trend acceleration assumes that at some point everything will go back to a slightly altered normal. Some compare this crisis to the tragic and frightening events of the 9/11 attacks on the World Trade Center in 2001. It interrupted lives, especially in New York City, but within a year or so, despite the loss of loved ones and additional security in airports, life and work continued mostly as before. Today’s crisis, however, is different. Everyone in the world is personally affected. Everyday life is disrupted. The impact of other issues such as racial injustice, economic inequality, and climate change are now impossible to ignore.

And the longer disruption continues, the more fundamental the impact will be. When people say “trend acceleration” are they really taking everything into account?

After other global crises of similar duration and magnitude, life did not return to normal. Wars, economic depressions, and pandemics defined entirely new eras because fundamental assumptions changed. In this kind of crisis, investing can be terrifying. How confident could an investor have been about their strategy in 1917, 1930, or 1939?

The longer this goes on, the more likely new behaviors will become permanent. According to a study conducted by researchers at the University College of London in 2009, new habits are established in 18 to 254 days.[1] At the end of 2020, there have been at least 300 days of Zoom calls, social distancing, and limited travel. New habits are replacing old habits. Even when vaccines and therapeutics become universally available, returning to pre-COVID behaviors will be difficult.

Active participants in the market may have a reasonable idea about which asset classes will weather expected changes (such as Class A+ Offices in Manhattan, multifamily in the suburbs, or Amazon distribution centers), but every “certain” investment thesis will become less certain the longer the crisis goes on. More than once, I have heard active investors say some version of the following, “This is a great time to invest…but I hope we are right.”

In this environment, it doesn’t make sense to resist change. The world will not do what we want it to do, just as the millions of tenants will not do what we think they should do. As Evert Verhagen, a consultant on how to understand and design cities said, “Expecting everyone to behave according to your thoughts is simply authoritarian, dictatorial stupidity. It just doesn’t work.”[2]

So, instead of asking when or how we will return to normal behavior, it might be more instructive to ask, what are people doing right now and why? Here are a few observable trends to consider:

WORKING FROM HOME

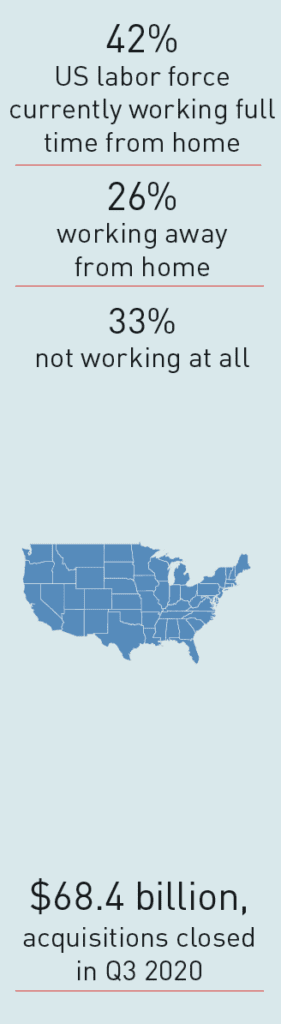

According to surveys conducted by Nicholas Bloom, a Senior Fellow at the Stanford Institution for Economic Policy Research, 42% of the

US labor force is now working from home full time, 26% are working away from home and 33% aren’t working at all. Two thirds of US economic activity now come from the 42% that are working at home.[3] A large number of companies plan to allow employees to work from home after the pandemic is over. Many estimate that employees will work from home on average two to three days per week, permanently.

TRAVEL

For more than a hundred years, companies have relied on salespeople traveling to meet clients and prospects in person, share a meal, and make the case for purchases big and small. But what do those salespeople actually do when they are “on the road?” There are a couple of things that immediately come to mind: (1) building trust in people and assets and (2) expanding networks. As smart salespeople find ways to fill their book of business and meet new customers without travel, it makes sense to ask, “how much travel and in-person connection is actually needed to sell?”

Until this year, it would be imprudent to make a commercial real estate investment without visiting the asset, perhaps several times. However, despite a drop in transactions, US$68.4 billion of acquisitions still closed in the third quarter of 2020.[4] That’s a lot of deals to underwrite when travel is so difficult. Investors improvised with trusted parties able to reach the properties, virtual tours, and very limited in-person visits. This invites the question, “how much in-person inspection is actually required?”

INTERPERSONAL CONTACT

People are going to extraordinary lengths during this pandemic to see each other in person—whether it’s online, in parks, on sidewalks, or even parking lots. Unfortunately, there are also a great number of people ignoring social distancing entirely, driving new spikes in infection rates. Humans need contact, but today they are spending much more time with family and close friends and are even learning how to cook. How much of those behaviors will linger when the crisis lifts? After the Great Depression in the 1930’s, an entire generation continued behavior learned during the crisis for the rest of their lives. Are we seeing a beginning of a similar change in priorities?

A year or more without vacation travel may change behaviors as well. It’s difficult to believe that people will continue to stay put once travel restrictions are lifted, but will they travel at the same frequency? No longer in the habit of spending large portions of their disposable income on a trip or two every year, how long before they return to that frequency, especially if the cost of travel is higher than it was before?

These are just a few observable trends. There are many more, of course. But these observations should prompt important questions for every investor in real estate:

Should we change the process for investment due diligence?

Are there sources of data that can better assess value, risk, and expected pro-formas that do not rely on the collected heuristics or “gut instinct” of an investor visiting a property? With new processes and habits learned in this time of crisis, can the process be improved?

Will we continue to need more than 11 billion SF of the office space currently in the US? [5]

Will we need all the cubicles, desks, lobbies, and reception areas, or can that space be used for something else? What might it cost to re-purpose? If workers are commuting less, will that impact parking requirements, mass transit infrastructure, and official office hours?

What about hotels?

There are more than five million guest rooms in the US. Before COVID, more than 75% were filled with business travelers.[6] Certainly, most of those rooms are not getting filled this year. What will it take to bring hotels back to life? How long before hotel demand goes up again? How many business trips will actually happen in a post-COVID world after a year or more of virtual contact?

How will housing change?

With many people confined to their homes during the pandemic, migration to suburbs and the “sunbelt” region of the US have accelerated. On the other hand, walkability and proximity to services such as retail and office space is high on the list for generations that resist long commute times. Does this mean that demand for higher density mixed-use village-like communities in suburbs will increase?

What will retail look like?

According to Adobe Analytics, since COVID began, US online sales increased 43% year-over-year.[7] Of course, in a time of social distancing and stay-at-home orders, more people will choose to provision themselves online, but how much of that habit will outlast the pandemic? Do consumers actually need the 13.7 billion SF of retail space in the US today?[8]

Investors have to accept that change has already happened. According to Ekemini Uwan writing in Atlantic Magazine, “I have come to believe that the only way to move forward is to grieve the life we once knew, and to shift our mindsets to radical acceptance of our present reality in order to create a new normal that is better than our pre-pandemic life.”[9]

Of course, most people are uncomfortable with the adjustments they have to make in a time of COVID. It is important to realize, however, that every change in life, every new learned skill, process, or environment comes with discomfort.

The more we learn, however, the more comfortable we can be. It isn’t easy to accept the world as it is right now, but if we do, we will likely thrive. As Carl Jung once wrote, “Wir können nichts ändern, bis wir es akzeptieren” (We cannot change anything until we accept it).[10]

—

ABOUT THE AUTHOR

Gunnar Branson is the CEO of AFIRE, the association for international real estate investors focused on commercial property in the United States.

NOTES

1. Phillippa Lally, Cornelia H. M. Van Jaarsveld, Henry W. W. Potts, and Jane Wardle, “How Habits are Formed: Modelling Habit Formation in the Real World,” European Journal of Social Psychology 40 (2010): 998–1009. Published online July 16, 2009 in Wiley Online Library (wileyonlinelibrary. com) DOI: 10.1002/ejsp.674

2. Evert Verhagen, interviewed in a video essay by Jan Dirk van der Burg “Olifantenpaadjes” (Desire Lines) 2011, https://vimeo.com/33178440

3. May Wong, “Stanford Research Provides a Snapshot of a New Working-From-Home Economy,” Stanford News (June 20, 2020), https://news.stanford.edu/2020/06/29/snapshot-newworking-home-economy

4. Real Capital Analytics, “US Commercial Real Estate Sales Tumble Again in Q3,” Capital Trends (October 21, 2020), https://www.rcanalytics.com/usct-overview-q3-2020/

5. NAREIT Research, “Estimating the Size of the Commercial Real Estate Market in the US.” https://www.reit.com/data-research/research/nareitresearch/estimating-size-commercial-real-estatemarket-us

6. American Hotel & Lodging Association. FAQ page accessed October 26, 2020. https://www.ahla.com/faq

7. Stephanie Crets, “US online sales rise 43% amid Pandemic in September,” Digital Commerce 360, October 19, 2020. https://www.digitalcommerce360.com/article/coronavirusimpact-online-retail/

8. Edmund Mander, “US has 13.7 billion square feet of retail real estate, valued at $2.4 trillion: Report” International Council of Shopping Centers, July 11, 2019, https://www.icsc.com/news-and-views/icsc-exchange/u.s.-has-13.7-billion-square-feet-ofretail-real-estate

9. Uwan, Ekemini, Uwan, “There’s No Going Back to ‘Normal,’” Atlantic Magazine, June 13, 2020. https://www.theatlantic.com/family/ archive/2020/06/radical-acceptance-pathchange/613015/

1.0 Carl Gustov Yung, Seelenprobleme der Gegenwart (Modern Man in Search of a Soul). Translated by Cary F. Baynes with William Stanley Dell. (London: Kegan Paul, Trench, Trubner and Co.)

—