HOW OPPORTUNITY ZONES CAN DEFER AND EXCLUDE GAINS FOR NON-US INVESTORS IN US REAL PROPERTY

For nearly forty years, non-US persons investing in US real property interests (USRPIs)1 have become intimately familiar with the complexities of the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA). FIRPTA taxes virtually all sales (and many exchanges) of USRPIs by non-US persons and requires 15% of the amount realized from such sales and exchanges to be withheld and remitted to the US Treasury by the buyer or transferor. However, the Tax Cuts and Jobs Act of 2017 (TCJA) introduced the concept of Qualified Opportunity Zones2 which offer the unique ability to defer, and possibly eliminate, US federal income taxes on certain gains generated by non- US persons with respect their USRPIs.

Although created to incentivize investments in designated Qualified Opportunity Zones (OZs), if structured appropriately, non-US persons with USRPIs can find a path to the emerald city that not only greatly diminishes their US federal income tax liability but also, potentially, mitigates the harshness of the FIRPTA regime.

The material US federal income tax benefits of the OZ program (and how such program can impact FIRPTA) include:

- The current deferral of US federal income taxes until no later than December 31, 2026 of such non-US person’s gains taxed as capital gain, from the sale or exchange of property to or with an unrelated person (Deferred Gain) – and reinvested in a Qualified Opportunity Fund (OZ Fund)

- A potential 15% exclusion from US federal income taxation of the Deferred Gain subject to a 7-year holding period3

- A potential total exclusion of the US federal income tax on a subsequent disposition of the OZ Fund interest received after a 10-year holding period

OZs are designated low-income tracks located throughout the US and its territories and possessions. The reinvestment in an OZ must be made through an OZ Fund, which is generally a US partnership, corporation, or limited liability company formed for an OZ investment.

An OZ Fund can be owned directly or indirectly by one or more persons and also can be structured as a traditional real estate private equity. Moreover, because there are no limitations on the type of taxpayer eligible to take advantage of an investment in an OZ, non-US taxpayers (including corporate and non-corporate non-US taxpayers) are eligible to reinvest gains taxed as capital gains in an OZ and take advantage of the substantial US federal income tax benefits. While there are intricacies to the program (which are only highlighted in this article), and some methods to avoid FIRPTA withholding as noted above, OZs provide non-US investors in US real estate a unique avenue to avoid FIRPTA and defer (and reduce or eliminate) US federal income taxes on the sale of a USRPI and subsequent investment in an OZ Fund.

GAINS ELIGIBLE TO BE REINVESTED

Recently proposed regulations indicate that only gains taxed as capital gains (e.g., short- and long-term capital gains, unrecaptured 1250 gains and net 1231 gains (e.g., net gains from assets or real property used in a trade or business)) can be deferred and reinvested in an OZ Fund. Those gains must result from a sale or exchange recognized prior to January 1, 2027, to or with an unrelated person (with relatedness set at a low 20% cross-ownership).4

Unlike a like-kind exchange under Section 1031, only gains need to be reinvested and amounts treated as a return of capital (i.e., a return of basis) can be retained by a taxpayer without being subject to tax. The Deferred Gain must be reinvested only in equity interests in an OZ Fund and reinvestment must be made within 180-day period generally beginning on the sale or exchange date, with some very notable exceptions. For example, this period begins on the last day of the taxable year for sales or exchanges by a partnership or with respect to net Section 1231 gains.

Because only gains taxed as capital gains are eligible for deferral and reinvestment, ordinary income items, such as inventory and recaptured gain under Section 1245 (including recapture from cost segregation), are excluded.5

QUALIFYING AS AN OZ FUND

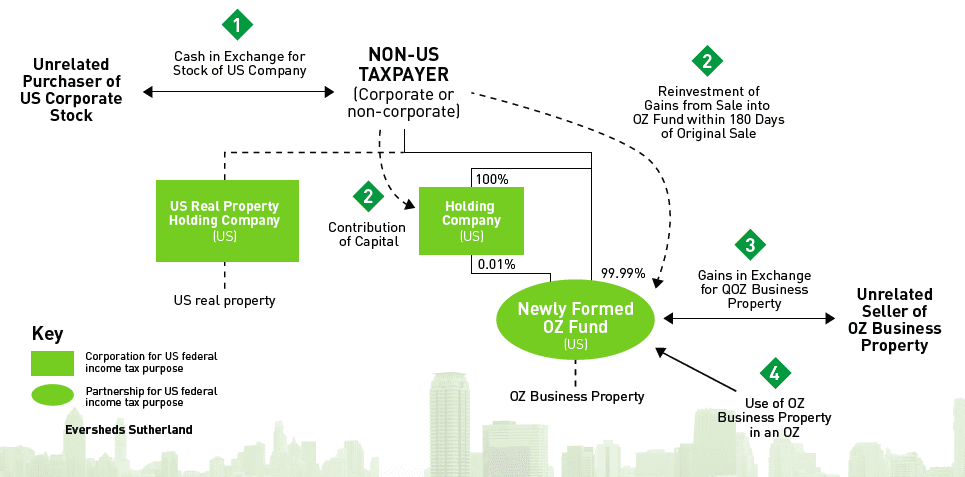

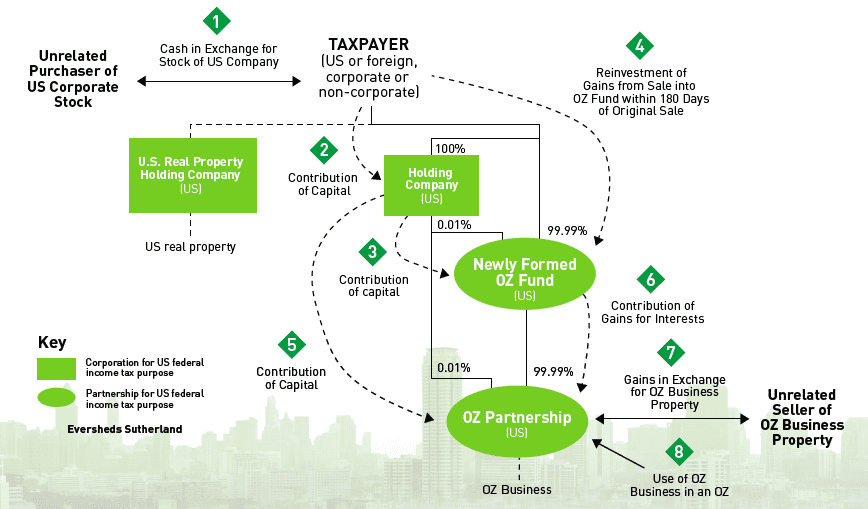

For an OZ Fund to qualify and retain its status, it must hold 90% of its assets as qualified OZ stock, partnership interests, or business property. An OZ Fund that directly holds only OZ business property has been termed a “direct investment” (Exhibit A). An OZ Fund that holds interests in OZ stock or partnership interests that in turn invest in an OZ business has been termed an “indirect investment” (Exhibit B). Whether a direct or indirect investment is used, there must be an active trade or business undertaken which does not include passive activities (e.g., triple net leasing real property).6 There are also different requirements for direct and indirect investments. Notably, indirect investments are only required to have net 63% qualifying OZ property.7

Additionally, an OZ Fund directly or indirectly must acquire property whose “original use” begins directly or indirectly with the OZ Fund or, alternatively, which is “substantially improved.” Substantial improvement means that within 30 months “additions to basis with respect to the property” exceed the adjusted basis of a building, generally beginning from the acquisition date of the property. However, there are some exceptions to this rule, including carve-outs helpful for construction projects. For example, with respect to land and a building, land can never have an original use and the original use of a pre-existing building cannot commence with the acquiring OZ Fund if it has been placed into service previously or has not been vacant for at least five years. The IRS has ruled that amounts needed to “substantially improve” within 30-months are only with respect to buildings (or purchase price amounts allocated to a pre-existing building) and that the land itself does not need to be separately substantially improved.

INCLUSIONS AND EXEMPTIONS OF DEFERRED GAIN

The Deferred Gain can be deferred to December 31, 2026 at the latest. A seven-year holding period (i.e., from 2019 to 2026) can result in 15% of the Deferred Gain being permanently excluded. The amount recognized as income is the lesser of the Deferred Gain minus the taxpayer’s adjusted tax basis in its OZ Fund interest, or the fair market value of the OZ investment minus the taxpayer’s adjusted tax basis in its OZ Fund interest. Although all taxpayers begin with a zero basis in their OZ Fund interest, holding the OZ Fund interest for fi ve years increases a taxpayer’s adjusted tax basis by 10%, and seven years increases a taxpayer’s adjusted tax basis an additional 5%, reducing the gain eventually included by up to 15%.8

DISPOSITIONS OF AN OZ FUND

If a taxpayer holds the OZ Fund interest for at least 10 years, the taxpayer can elect to increase its basis in the OZ Fund to the fair market value of the interest at the time of sale or exchange, provided it occurs on or before December 31, 2047. Debt encumbering the OZ Fund or its assets are included in the fair market basis increase.

With respect to an indirect investment holding multiple properties (Exhibit B), the current proposed regulations do not currently allow for a full basis step-up to the extent that each property or OZ Partnership Interest are sold, (although many have requested that the regulations be modified to ensure a full basis step up for sales of qualifying OZ property). The practical result of this is that both ordinary income and gains taxed as capital gains are not subject to US federal income tax. Many US states have conformed their state income tax treatment to follow the federal treatment for investments in an OZ. Some states have also included additional tax credits and other incentives for OZ investments made in their state.

THE FIRPTA GAUNTLET

The sale or exchange of a USRPI by a non-US person is almost invariably subject to US federal income tax at graduated rates under FIRPTA (applying a deemed trade or business), but it does not generally impact the underlying character of the income (i.e., as capital gain, ordinary income, or Section 1231 gains).9 Additionally, the deferral and exclusion benefits of the OZ regime should extend to eligible FIRPTA gains. One potential complication is the 15% FIRPTA withholding tax on the amount realized which is effectively a prepayment to ensure the underlying FIRPTA tax is fulfilled.10

To avoid the FIRPTA withholding tax, a non-US person should generally be able to apply for a withholding certificate from the IRS to reduce or eliminate the withholding tax on a sale of a USRPI to invest in an OZ Fund and a subsequent sale of an interest in an OZ Fund.11 When such a withholding certificate is provided to the applicable withholding agent (generally, the purchaser of the USRPI), the agent may rely on the certificate to reduce or eliminate the withholding under Section 1445 without being liable for such withholding or any applicable interest.12 Although technically discretionary, the regulations under Section 1445 clearly allow for issuance of such a certificate where there is a reduction in the amount of withholding or for other specified reasons.13 As such, a reduction or elimination of US federal tax for eligible gains under Section 1400Z-2 should fi t squarely within the IRS’ discretion to issue a certificate to reduce the Section 1445 withholding tax on transfers of USRPIs.14

Although the applicable rules indicate that the IRS will rule on a withholding certificate within 90 days of receiving an application, transactions can be structured to be contingent and close upon receipt of such a certificate. It has been reported, however, that future guidance is anticipated to address withholding due under Section 1445 in the OZ context.

In a US tax world where non-US investors in US real estate are virtually always taxed on dispositions of a USRPI, the OZ rules of Section 1400Z-2 provide an appealing possible avenue to reduce and eliminate US federal income tax. Investments in an OZ should certainly be considered as a potential tax planning tool when a disposition of a USRPI is contemplated.

—

ABOUT THE AUTHOR

James (Jamie) S.H. Null is a partner at Eversheds Sutherland, focused on international tax planning for corporate, partnership and real property transactions, including private equity investments and structures using US and non-US treaty networks and individual and institutional investors.

NOTES

1. The definition of a USRPI is broad and includes traditional fee and leasehold interest in real property located in the continental US or the US Virgin Islands (including improvements and land), interests in a partnership, estate, or trust (domestic or foreign) to the extent that the assets of these interests are USRPIs, stock in a US entity treated as a corporation for US federal income tax purposes whose assets currently (or in the past 5 years) are comprised of 50% or more of USRPI, personal property associated with the use of real property (e.g., mining and construction equipment, tangible personal property used in a lodging facility, etc.) and debt which is not or a character that is solely of a creditor (e.g., a loan that has an equity kicker or sweetener on a USRPI). Excluded from USRPIs are 5% or less interests in publicly traded stock and interests in domestically controlled REITs. Certain other taxpayers like sovereign wealth funds and pension funds can also avoid US federal income taxation on the disposition of certain USRPIs.

2. In addition to the applicable sections of Internal Revenue Code of 1986, the US Department of Treasury released proposed regulations in 2018 and 2019 which added additional clarity to the rules of Section 1400Z-2.

3. All taxpayers in an OZ Fund begin with an adjusted tax basis of zero. A 5-year holding period in the OZ Fund results in the adjusted tax basis of the OZ Fund interest increased to 10% of the Deferred Gain. An additional 5% increase in the taxpayer’s adjusted tax basis OZ Fund (for a total of 15% of the Deferred Gain) is available if a 7-year holding period is met. Importantly and under current rules, to obtain the 5% step-up in basis and thus a full 15% basis increase, the applicable taxpayer must invest in an OZ Fund by December 31, 2019. Th e gain eventually recognized on the applicable triggering date also steps up the taxpayer’s adjusted tax basis in the OZ Fund.

4. The 2018 Proposed Regulations include preferred stock and partnership interests with special allocation as equity interests but expressly exclude debt instruments within the meaning of 1275(a)(1) and Treas. Reg. §1.1275-1(d). Helpfully, the use of an equity interest as collateral for a loan (including with respect to purchase-money borrowing) is expressly permitted and is not treated as a triggering event. Prop. Treas. Reg. §1.1400Z-2(a)-1(b)(3)(ii).

5. Section 1245 of the Code recharacterizes gain from the sale of certain depreciable property to ordinary income while Section 1250 of the Code also recharacterizes gain from a sale of certain depreciable real property to ordinary income. Section 1245 recapture could result with respect to US real property that was cost segregated in order to provide a faster depreciation timeline. It should be noted that the exclusion of Section 1250 recapture is likely of limited practical effect as most real property is depreciated under the applicable straight-line method.

6. It is unclear whether a net election under Section 882(d) or 871(d) or under an applicable US income tax treaty which deems a non-US person to be engaged in a US trade or business and thus taxable on a net basis would be sufficient to be an “active trade or business.”

7. The Proposed Regulations have clarified that “substantially all” for a US corporation or partnership to qualify as OZ Stock or OZ Partnership Interests must only hold 70% Business Property. Th e 63% indirect interest stems from a formula of 90% x 70% = 63%. 90% represents the OZ property that an OZ Fund must hold, and the 70% is the amount of OZ Business Property that a US corporation or partnership must hold to be considered OZ Stock or OZ Partnership Interests.

8. In addition, in an OZ Fund that is treated as a partnership, a partner’s allocable share of debt is also refl ected in their basis in the OZ Fund interest which can result in the partner’s having some initial basis and, potentially, allowing for use of losses generated by the OZ Fund’s direct or indirect trade or business.

9. See, e.g., Botai Corp., N.V. v. Comm’r, 60 TCM 681 (1990), aff ’d without published opinion, 935 F2d 1280 (3d Cir. 1991) (holding that Section 897 taxes dispositions regardless of whether the income is capital or ordinary and held that underlying gain of property which an installment note was provided was capital gain).

10. See Section 1445. Th e Section 1445 withholding tax is merely a prepayment of US federal income tax due on such a sale or exchange of a USRPI. To the extent the withholding is greater than the actual tax liability as is frequently the case, an applicable non-US taxpayer seller or transferor can fi le for a refund through fi ling of a US federal income tax return with the IRS.

11. Treas. Regs. §§ 1.1445-3 & 1.1445-2(d)(7).

12. A withholding certifi cate issued under Treas. Reg. §1.1445-3 aft er a transaction can also be an expedited refund request pursuant to Treas. Reg. §1.1445-3(g) with respect to the over withheld amounts.

13. Treas. Regs. §§1.1445-3(b)(4), (5) & (6).

14. An applicant must meet all the requirements of Treas. Reg. §1.1445-3(c), including settling or substantiating the lack of any withholding tax due which is attributable to the property. Th is may be tricky with respect to USRPIs that have been transferred multiple times. It is somewhat unclear whether the applicable taxpayer would indicate on the IRS Form 8288-B that Section 1400Z-2 transaction is one that is a “nonrecognition” transaction or one that the tax due is less than the amount of withholding. In this context, one would assume that the requirements to describe the transaction in a manner consistent with a nonrecognition transaction would be more applicable and prudent for a non-US person’s application.

THIS ARTICLE ORIGINALLY APPEARED IN SUMMIT: ISSUE #2