Bridge Investment Group’s 2024 Outlook suggests that, to navigate the curve for the year ahead, accelerate through the turn and find the appropriate entry and exit points, rather than trying to perfectly time the market.

As we reflect on the year gone by, we see a period marked by uncertainty, resilience, and adaptation. Still making our way through uncertainty, there are meaningful implications for 2024. Despite the impact of a higher interest rate regime, conviction in investment strategies with robust fundamentals has only been reinforced.

We see the rate environment as likely to shift downward in 2024, which underscores the importance of focusing on secular tailwinds and maintaining a long-term perspective.

Two important mainstays from 2023 that we anticipate will continue in 2024: the strength of both the labor market and the consumer. These drivers are not only crucially important for the health of the economy overall, but also provide tailwinds for demand-driven sectors.

A core set of themes for US commercial real estate 2024 include the severe undersupply of housing, the critical need for industrial and logistics infrastructure, and the broadening opportunity for private real estate-backed debt. Across these themes, we see pockets of opportunity for distressed assets and portfolios, and we anticipate seeing these emerge in greater velocity throughout the year ahead.

SECULAR THEMES

CRE OVERALL

CRE is entering a new expansion phase, with resetting asset values opening up fresh opportunities, particularly in private credit focused on real assets.

A large amount of distressed loans and maturing debt in 2024 is likely to drive a wave of opportunistic transactions, which will likely benefit asset managers who adapt quickly to these market conditions.

PRIVATE REAL ASSET CREDIT

With public banks constrained by regulations and risk mitigation, private credit providers have the opportunity to tap into the unmet demand that we anticipate to see as transaction volume accelerates. Additionally, there are attractive tailwinds in sectors such as multifamily and logistics.

The ability to capture greater market share extends beyond mere volume. Expect tighter lending conditions as likely to drive higher-quality borrowers towards private credit. This shift positions private credit providers to gain increased bargaining power in new originations, purchases of existing debt, bridge loans, and portfolio sales.

LOGISTICS

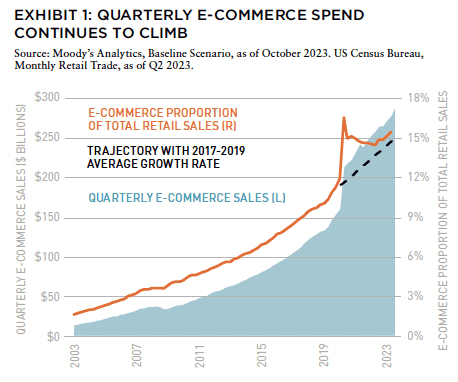

The logistics sector has seen robust demand tailwinds over the past decade, and we anticipate these will accelerate with sustained e-commerce growth, global trade alignment, onshoring, and growth in business inventories. The combination of these factors has produced historically low vacancy rates and real rent growth well above the long-term average.

Demand and supply imbalances are anticipated to continue in select high-volume markets, creating compelling opportunities, even with moderating consumption. Given the sea change in interest rates, with valuations down and increased pressures to create liquidity for some asset owners, we anticipate seeing increased opportunities for acquisitions at compelling discounts to replacement costs.

MULTIFAMILY

Expect to see the multifamily sector experience a significant supply surge in 2024. But by the end of the year, anticipate a rebalancing of supply-demand dynamics and a path towards undersupply.

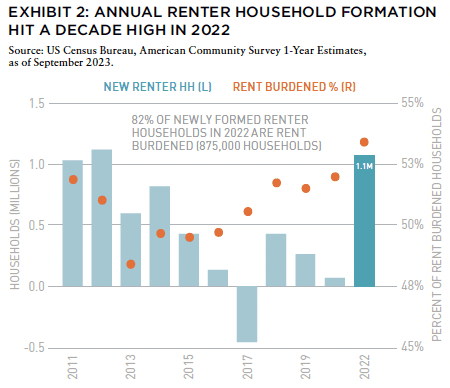

Anticipate increased demand from a new generation of renters, particularly younger individuals. However, affordability remains a major issue, with a high percentage of renter households being cost-burdened. Despite these pressures, the sector is expected to show resilience, with potential for modest rent growth and improved rent collections.

SINGLE-FAMILY RENTAL

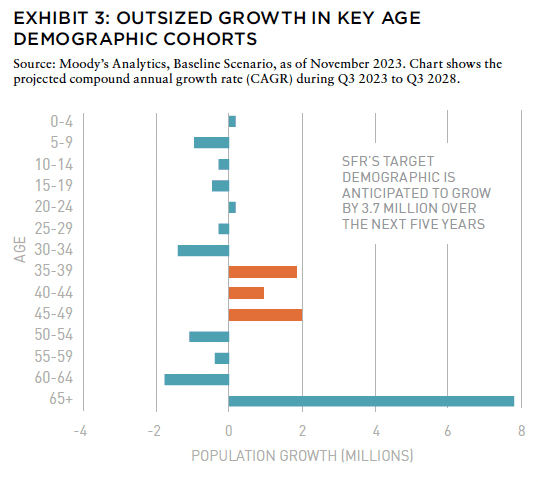

The SFR sector is expected to thrive in 2024, driven by a strong macroeconomic environment, demographic trends favoring rental demand, especially in the Sunbelt region, and barriers in the single-family ownership market, such as chronic undersupply and elevated homeownership costs.

Demand for SFR is likely to increase, fueled by demographic growth and economic factors, including the expansion of the prime age cohort for SFR. High home prices and interest rates have made homeownership less accessible, which is a key contributor to a growing tenant pool.

NAVIGATING THE ECONOMIC HORIZON

Entering 2024, we build on the economic momentum gained in 2023, a year that showcased remarkable resilience. This resilience was evident despite central banks’ rapid interest rate hikes and significant events in the banking sector ranging from mid-size US regional banks to major global institutions. A number of key economic indicators and trends are shaping the opportunity set for alternative asset investment landscape.

THE ECONOMIC LANDSCAPE OF 2023 / A FOUNDATION FOR 2024

The story of 2023, in economic terms, was one of remarkable endurance. The US economy displayed resilience that defied expectations, particularly mid-year anticipations of a labor market downturn and a potential recession. Providing meaningful economic tailwinds, the labor market remained robust, accompanied by remarkable growth rates. We anticipate there is additional resilience ahead, setting the stage for the 2024 Outlook and providing a backdrop against which to assess opportunities across real assets, credit, and private equity.

THE ROLE OF INTEREST RATE POLICY: A BALANCING ACT

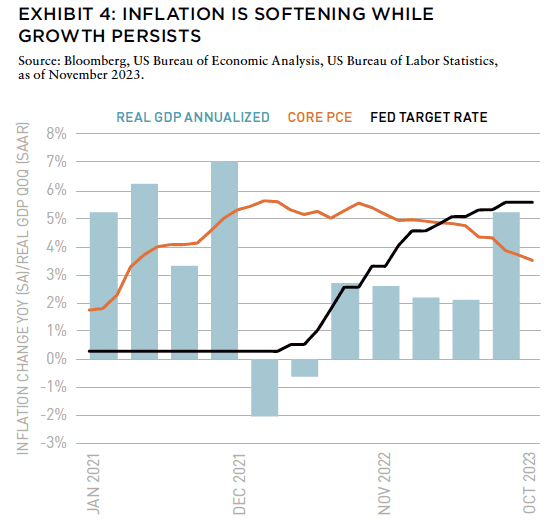

Central to the 2024 narrative is the role of the Federal Reserve (Fed) and the potential downward shift in interest rates over the year. In our view, the Fed’s final policy meeting in 2023 was likely an indication that not only was its rate tightening campaign finished, but we are likely to see multiple rate cuts by year-end.

Over the past year, the US economy has managed to stay atop choppy waters while reducing inflation to nearly three percent with minimal impact on growth.5 We believe this trend will continue into 2024, with inflation gradually aligning with the Fed’s targets. However, at the same time economic growth will likely be moderate in 2024 before accelerating toward year-end. We expect this growth to be based on the combination of a stable labor market, modest consumer activity, decelerating inflation, and interest rate cuts in the second half of the year.

RISKS TO THE OUTLOOK

Some risks to the outlook remain. For example, even with the gradual decrease in inflation, the central bank remains cautious about decelerating shelter costs. In navigating monetary policy, timing is essential; premature rate cuts risk reigniting inflation, jeopardizing the stability achieved over the past year. Looking ahead to 2024, there are several key challenges.

- Sticky inflation, where prices in some sectors are slow to adjust to interest rate changes or changing economic conditions. This type of inflation, which constitutes over two-thirds of the overall rate, is declining but its persistence may necessitate prolonged high interest rates.6

- The labor market, while strong throughout 2023, is showing signs of cooling heading into 2024. Wage growth is decreasing and job growth, while still positive, is losing momentum. In our view, this suggests a shift towards moderation rather than a downturn.

- Consumer debt is another critical area, especially with high interest rates. Younger consumers face increasing debt burdens, highlighted by the resumption of student loan payments and a rise in credit card debt, which now stands at $1.08 trillion, predominantly held by those aged 30-59.7 This may impact consumer spending, crucial for economic vitality. Furthermore, banks’ continued strict lending standards limit access to credit for both individuals and businesses.

- The bond market also faces uncertainties, with increased volatility stemming from economic and geopolitical changes potentially leading to higher government deficits and debt, which could exert upward pressure on yields.

Despite these risks, the outlook for 2024 is cautiously optimistic. We anticipate the economy to maintain moderate growth, supported by the labor market and consumer strength.

MOMENTUM DRIVER #1: THE LABOR MARKET

Over the course of 2024, we expect the labor market to maintain stable growth, though monthly job growth may moderate as businesses and consumers adjust to the potential for long and variable lags of rate hikes. We expect high labor force participation should continue, buoyed by wages that remain elevated compared to the prior two economic cycles.

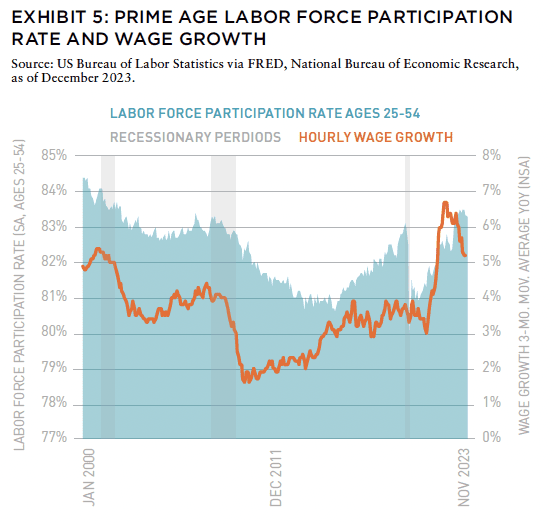

We see the labor market’s resilience as a standout feature of 2023, withstanding rate hikes and remaining robust in a historical context. Factors like wage growth and demographic shifts pushed the labor force participation rate to a 20-year high of 83.5% in the prime age group (between 25 and 54 years old). However, mismatches in supply and demand, especially in sectors like healthcare and leisure and hospitality, persisted.9 Unemployment levels stayed historically low, with only a slight increase from 3.4% in January to 3.7% in November, in part due to a growing labor force.

MOMENTUM DRIVER #2: CONSUMER SPENDING

Fortifying household balance sheets creates the potential for increased momentum for the US consumer in 2024, and we have seen how wage growth helped establish a strong foundation entering the year.10 Excess savings in liquid household accounts grew by 30% from 2019 to 2022.11 This boost supported retail spending, which saw an average monthly growth of 3.2% year-over-year in 2023, slightly below the previous cycle’s average of 3.9%.12 A major driver of US GDP, consumer spending helped reduce the household debt to GDP ratio to the lowest level since 2005 at 2023’s start. In 2024, we anticipate decelerating price pressures are likely to sustain moderate growth in consumer spending.

A ROAD PAVED WITH CAUTIOUS OPTIMISM

As we look towards 2024, the narrative of the US economy is one of cautious optimism. The implication for the rate environment and its influence on alternative assets, particularly real assets, is the strong likelihood that interest rates will remain higher for longer and require a conservative approach in the face of higher borrowing costs. However, in our view the strength of the underlying economy will continue to provide tailwinds to select demand-driven sectors. Consumer spending activity, a key driver of economic health, have remained consistent, reflecting the resilience of the American consumer. This resilience, underpinned by a stable labor market, highlights the secular strength driving a number of real estate sectors such as residential rental (broadly defined as multifamily, workforce and affordable housing, single-family rental), logistics and advanced manufacturing, and private credit strategies focused on real assets.

IN THIS ISSUE

NOTE FROM THE EDITOR: WELCOME TO #14

Benjamin van Loon | AFIRE

INSURING FOR ELSEWHERE: CLIMATE-RESPONSIVE REAL ESTATE INVESTMENT

Benjamin van Loon | AFIRE

INSURING FOR ELSEWHERE: STRIPPING THE CASHFLOW FROM THE DEAL

Paul Fiorilla | Yardi

MARKET OUTLOOK: MODEST GROWTH AND RETREATING INFLATION IN 2024

Martha Peyton, CRE, PhD | LGIM America

UNDERPERFORMANCE PARADOX: NEW RESEARCH QUESTIONS THE VALUE OF PRIVATE REAL ESTATE FUNDS

William Maher, Taylor Mammen, Ben Maslan | RCLCO Fund Advisors

NAVIGATING THE CURVE: RESILIENCE, ADAPTATION, AND PREPARING FOR 2024

Jack Robinson, PhD | Bridge Investment Group

LIQUIDITY FREEZE: POTENTIAL SOLUTIONS FOR COMMERCIAL REAL ESTATE

Christopher Muoio | Madison International Realty

SUPPLY WAVE: REASON FOR OPTIMISM IN THE MULTIFAMILY SECTOR

Sabrina Unger, Britteni Lupe | American Realty Advisors

MANAGE WHAT YOU MEASURE: UNDERSTANDING EXPENSE INFLATION IN APARTMENTS

Gleb Nechayev | Berkshire Residential + Webster Hughes, PhD | ThirtyCapital

PARSING OFFICE DISTRESS: PLANNING FOR THE NEXT GENERATION OF OFFICE SPACE

Dags Chen, Lincoln Janes, CFA | Barings Real Estat

MODEL STATES: USING ECONOMIC STATE MODELS TO ASSESS THE US OFFICE OUTLOOK

Armel Traore Dit Nignan | Principal Real Estate

OUTWARD SHIFT: WILL THE LOGISTICS SECTOR CONTINUE TO OUTPERFORM?

Kerrie Shaw | AXA IM Alts

HARNESSING THE WIND: TECHNOLOGICAL CHANGE AND THE PROMISE AND PERIL OF AI FOR REAL ESTATE

Nikodem Szumilo | University College London + Chris Urwin | Real Global Advantage

MIND YOUR DATA: REAL ESTATE INVESTING, FROM THE POINT OF VIEW OF A DATA NERD

Ron Bekkerman, PhD

OPERATING EXPENSES RISING THE OTHER MAJOR COMPONENT OF NOI GETS MORE FOCUS

Stewart Rubin, Dakota Firenze | New York Life Real Estate Investors

IN MEMORIAM: JANICE STANTON

+ LATEST ISSUE

+ ALL ARTICLES

+ PAST ISSUES

+ LEADERSHIP

+ POLICIES

+ GUIDELINES

+ MEDIA KIT (PDF)

+ CONTACT

MACRO CURRENTS: POST-PANDEMIC SHIFTS SHAPING THE INVESTMENT LANDSCAPE

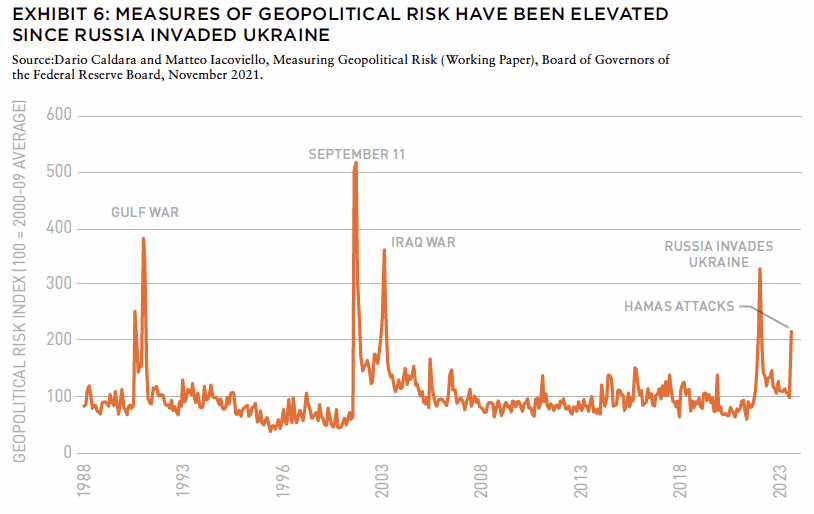

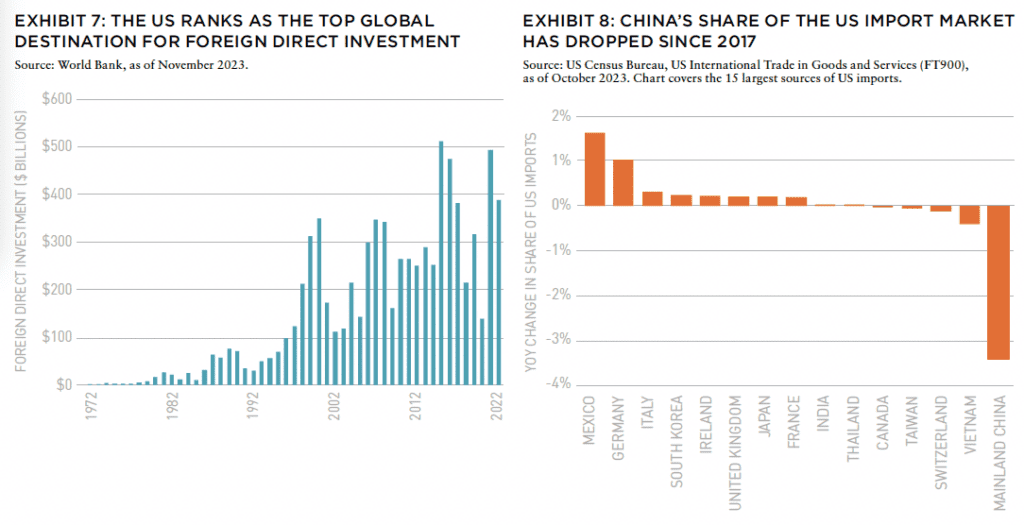

THE NEW GLOBAL LANDSCAPE: A worldwide resurgence of geopolitical uncertainty is catalyzing a shift toward Globalization 2.0 and reinforcing the views of the US as the preeminent destination for capital.14 With the intensifying US-China rivalry pulling in allies, ongoing conflict in Ukraine, and a new outbreak of hostilities in the Middle East, Globalization 2.0 is reshaping the contours of international finance and trade. In this evolving geopolitical climate suggestive of an increasingly multipolar world, we expect the US will continue to stand out for its robust consumer base and dynamic labor market.

EVOLVING CAPITAL FLOWS: The US continues to attract an outsized share of global capital and has emerged in recent years as the number one destination for foreign direct investment, bolstering productive capabilities and long-term growth prospects.16 We expect that the tangible impact of these capital flows will be most pronounced in goods-producing sectors, in part due to new federal measures to invigorate domestic manufacturing. Multiplier effects could ripple across additional sectors as vendors along the production chain ramp up operations to meet demand.

- US advanced manufacturing positioned for further acceleration, though job gains may be muted if firms turn to automation amid a still-tight labor market.

- Improved economic outlook in secondary and tertiary metros as legacy cities capture an outsized share of new activity.

ALTERED TRADE PATTERNS: Geopolitical considerations, rather than pure economics, are increasingly driving cross-border trade relationships and leading nations and multinational firms to turn to like-minded peers to source critical commodities and goods.18 The strategic tug-of-war between the US and China vividly illustrates this evolution, marked by stiff tariffs and new controls to safeguard technology and intellectual property. Already we note a substantial decline in China’s share of the US import market that, if continued, could pave the way for further regionalization in the cross-border movement of goods.19

- More diversified and resilient supply chains less vulnerable to systemic trade shocks.

- Uptick in industrial demand on the southern border and East Coast as shifting trade routes funnel imports through a wider number of US entry points.

- Potential for stickier inflationary pressures on a longer-time horizon as production relocates away from low-wage countries.

ACTIVE GLOBAL CONFLICTS: Ongoing and new conflicts underscore the potential for enduring volatility in global commodity markets during 2024. The war in Ukraine, involving two of the world’s top wheat producers, triggered a spike in global food prices.20 Separately, renewed hostilities between Israel and Hamas raises the prospects of wider instability that could throw a wrench into global oil markets if other regional actors are pulled into direct conflict.

- Though the US has a measure of protection against global price instability given its status as the world’s second largest agricultural producer and a net oil exporter, increased price volatility could filter through to consumers and dampen sentiment given heightened sensitivity to the cost of staples.21

CAPITAL MARKETS: GREAT (RESETTING) EXPECTATIONS IN COMMERCIAL REAL ESTATE

We believe CRE capital markets have navigated to a new cyclical baseline and are transitioning to the next phase of expansionary activity. CRE navigated bumpy skies in recent quarters amid an evolving rate environment that prompted a reevaluation of the sector’s risk-return profile. But as of early 2024, we believe the sector has refueled and taxied back to the runway, prepared for the next cycle of opportunity as asset values have reset meaningfully in many sectors. Looking forward to the next expansionary phase, we believe these capital market developments have meaningful implications for various segments of real assets, including private credit focused on real assets.

CERTAINTY ABOUT AN ACCELERATED PACE OF ACTIVITY WILL COME AFTER IT HAS ALREADY STARTED

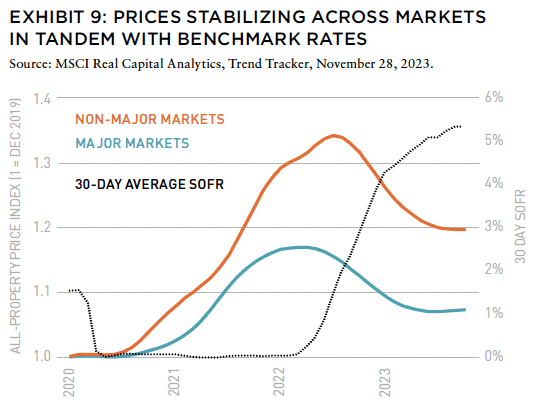

We see transaction activity start to accelerate through the curve in the first half of 2024, and our views of the sector’s cyclical momentum derive from three distinct but interrelated developments. First, baseline interest rates have started leveling out, providing increased clarity on debt costs and cash flow. Second, the market appears to have come to terms with the reset in values, which have shown increased steadiness in recent months across both gateways and secondary metros. Third, deal flow has started ramping up—in part forced by debt maturities—which opens the door to a faster pace of capital deployment. Momentum will be hard to measure as transaction volume will record closed transactions, resulting in a months-long lag.

SOME CHALLENGES LIE AHEAD

Despite these promising signals, hurdles still remain before a full resumption of activity can take place. In our view, we anticipate a meaningful shift from end-of-year 2023 conditions early in 2024.

At the end of 2023, still-frozen debt markets stood out as the biggest challenge to regular-way transactions as conventional lenders remain on the sidelines in risk-off mode, forcing borrowers to high-cost options and preventing a wider range of opportunities from penciling. Additionally, a meaningful bid-ask spreads persisted in pockets of the CRE sector as would-be sellers delayed bringing assets to market in hopes of improved valuations at a future date. These factors combined resulted in decreased transaction volume across all sectors, which we believe will be remedied with greater clarity on the trajectory of the rate environment during early 2024.

DISTRESS COMING TO FRUITION

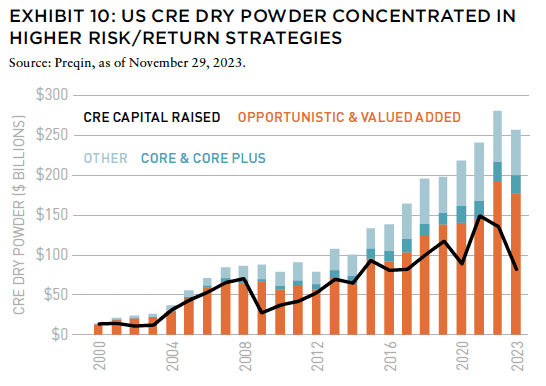

Until debt capital markets thaw and bid-ask spreads narrow, we anticipate that 2024 will see opportunistic plays account for an outsized share of deal flow compared to previous years, driven primarily by troubled loans and maturing debt. Across CRE, there was an estimated $65 billion worth of current distress as of the fourth quarter of 2023, and the number of troubled loans continues to edge higher because of either operational shortcomings or mishandled capital stacks.24 With $650 billion of CRE loans set to mature in 202425 into a conservative lending environment, we anticipate that many borrowers will find it difficult to refinance at workable terms and could be forced to sell.

We anticipate these opportunistic plays, once available, will transact quickly given the $177 billion wall of opportunistic and value-added dry powder ready to deploy early in the next cycle in search of greater upside opportunities from asset appreciation.26 As a result, we believe asset managers that have appropriately adapted to new market conditions will boast a distinct competitive edge, while those that wait for the green light may find the window of greatest opportunity closed.

PRIVATE REAL ASSET CREDIT: TAKING THE INSIDE LINE THROUGH THE CORNER

We believe private debt is likely to benefit from a confluence of factors ranging from the rapid rise in interest rates, near-term maturities and unanticipated refinancing conditions, and the potential for conventional lenders to be on the sidelines after a year of low liquidity. In our view, a broader opportunity set may be available to private debt markets as a result, but there is also the potential for increased selectivity and quality given borrowers’ lack of broader market options. We see nuanced opportunities in attracting high-quality borrowers at favorable terms as a meaningful tailwind for the sector in 2024.

DYNAMICS DRIVING PRIVATE CREDIT MARKETS

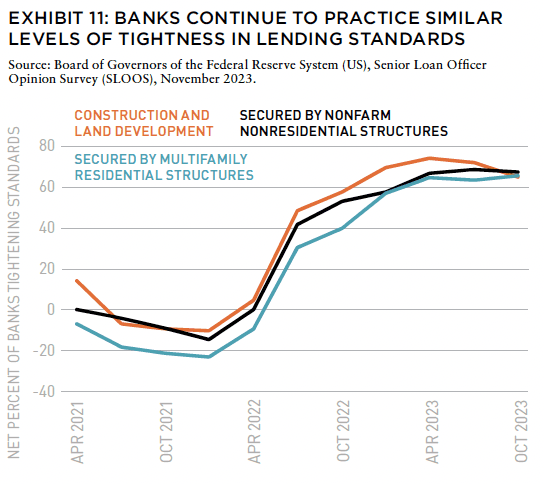

The global rise in interest rates has already reshaped financial conditions, which we see as contributing positively to private credit’s rise in 2024. For real assets, tightened lending standards in the US, influenced by early-2023 disruption in the banking sector and ongoing regulatory changes for conventional lenders, highlight the opportunities for private credit to provide clarity and surety in a complex capital markets environment.

HIGHER FOR LONGER VS. HIGHER FOR HOW LONG?

The Fed’s late 2023 signaling of the likelihood for rate cuts in 2024 is a meaningful pivot, but it does not change that we are in a materially higher rate regime. We see traditional lenders continuing to be cautious and sidelined, paving the way for private credit for real assets to capture value through opportunistic market dislocation.

TIGHTENING LENDING STANDARDS—WHAT IT MEANS FOR REAL ASSETS

As public banks tighten lending standards in response to increasing risks and regulatory pressures, we believe this creates a unique opportunity for private real estate debt to fill the gap. While the early-2023 banking sector turmoil was somewhat of a catalyst, a few factors contribute to the relationship between tightening credit conditions and implications for real estate debt. Over recent decades, banks have significantly increased their exposure to CRE. The resetting of asset values broadly compounded existing challenges stemming from high reserve requirements, reduced loan-to-value ratios, and increased regulatory oversight. As we anticipate these conditions to continue, we expect both large and mid-size public banks to maintain or further tighten lending standards in 2024.29

It is important, however, to not overstate default risk by placing current conditions in historical context. Despite an observable rise in CRE delinquencies, conditions are meaningfully lower at year-end 2023 than the start of the previous cycle. As of Q2 2023, the delinquency rate on bank commercial real estate mortgage loans was less than 1%, with a charge-off rate of only 0.16%.30 Comparatively, during the GFC, the delinquency rate was close to 9%, and the charge-off rate was 2.5%.31 We see this as an indication of secular resilience with resetting values largely embedded in capital markets heading into 2024.

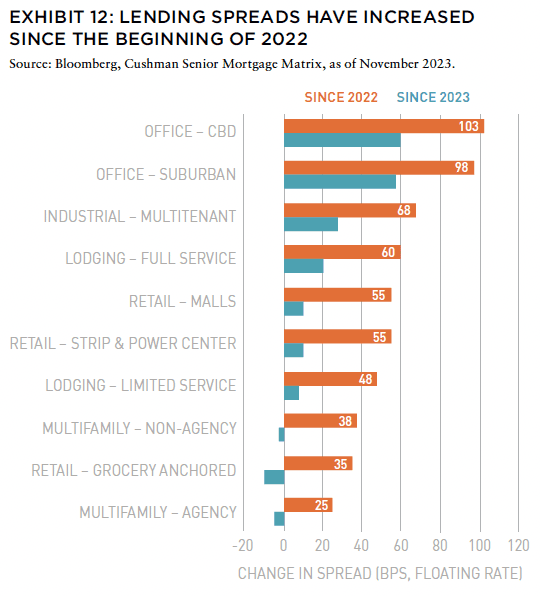

THE ROAD AHEAD: ACCELERATING TRENDS FOR 2024

In our perspective, significant market shifts over 2023 are gaining momentum with respect to the implications of higher interest rates and tighter credit conditions, which present a unique investment opportunity in private debt markets. For real assets, over the past year there has been a substantial reduction in active public real estate lenders (approximately 20-30%),32 and alongside the reduction in the number of active lenders, the market has witnessed an increase in spreads, ranging from SOFR plus 220 to SOFR plus 460, depending on asset type.33 This combination of higher base rates, widened spreads, and potentially more favorable loan terms represent an attractive opportunity set.

Additionally, the looming maturity of over $1 trillion in real estate loans in 2024 and 2025, over 35% of which are multifamily loans, coupled with elevated interest rates, has given lenders increased pricing and negotiating power.34

Non-conventional lenders, including private debt funds, have expanded CRE debt holdings at the fastest pace of any lender group since the Fed started the rate hike cycle in Q1 2022, while the volume of maturing CRE loans will continue to accelerate over the next few years. We believe that these trends suggest non-conventional lenders will continue to take market share as a function of both the build-up of maturing mortgages as well as new originations.

CONCLUSION: SEIZING OPPORTUNITIES AND NAVIGATING CHALLENGES IN 2024

In the year ahead, we believe that we are approaching the inflection point for US commercial real estate strategies, ranging from asset-backed credit strategies as well as equity investments in real assets and select business sectors. With the past year’s challenges not fully in the rear-view mirror, the focus is on navigating the curves ahead. “Accelerate through the turn” is not just a theme, but a strategy focusing on seizing the right opportunities rather than trying to time the market.

WHAT WE LIKE AND WHY

The reset in asset values and adjustments to the rate environment open doors to fresh opportunities. We anticipate a wave of opportunistic transactions driven by distressed loans and maturing debt in the CRE sector. These conditions present a compelling opportunity for asset managers who can act with conviction, deploy capital with surety, and quickly adapt to evolving market conditions.

The private credit sector is poised for significant growth. With public banks constrained, private credit providers can tap into what we believe will be robust demand from high quality borrowers and excellent assets. We believe there will be particularly attractive opportunities in sectors like residential rental and logistics, where we see strong demand-driven tailwinds and decelerating supply on the horizon. Moreover, tighter lending conditions are likely to divert higher-quality borrowers towards private credit, giving providers an edge in new originations and portfolio sales.

In the logistics sector, a slowdown in new construction looms, particularly in major coastal markets. However, this deceleration in supply comes at a time of sustained demand, driven by the growth of e-commerce and a reshaping of US supply chains.

While the multifamily sector is set to experience a supply surge, by year-end we anticipate a slowdown in new deliveries will shift supply-demand dynamics into favorable conditions. Further, we anticipate increased demand from a new generation of renters who are likely to experience affordability challenges in the absence of scalable strategies to restore balance across the spectrum of housing choices.

The SFR sector presents a robust outlook for 2024. Driven by strong labor market conditions for key age groups, demographic trends, and barriers in the single-family ownership market, we expect this sector will thrive in its second cycle of institutional expansion.

The strategy is clear: identify and leverage secular tailwinds, focus on high-conviction themes, and navigate through inflection points with conviction.

—

ABOUT THE AUTHOR

Jack Robinson, PhD, is Chief Economist and Head of Research for Bridge Investment Group.

—

NOTES

1. Moody’s Analytics. “Weekly Market Outlook: Defying Expectations.” https://www.moodysanalytics.com/-/media/article/2023/weekly-market-outlook-defying-expectations.pdf. Accessed October 2023; U.S. Census Bureau. “Retail Sales.” https://www.census.gov/retail/sales.html. Accessed August 2023.

2. U.S. Census Bureau. “American Community Survey (ACS).” https://www.census.gov/programs-surveys/acs. Accessed September 2023..

3. Moody’s Analytics, Baseline Scenario, as of November 2023. Chart shows the projected compound annual growth rate (CAGR) during Q3 2023 to Q3 2028. 4. Referencing data from Bloomberg; US Bureau of Economic Analysis; US Bureau of Labor Statistics; as of November 2023.

5. Referencing data from Bloomberg, as of November 2023.

6. Federal Reserve Bank of Cleveland. “Are Some Prices in the CPI More Forward-Looking Than Others? We Think So.” Economic Commentary, February 2010. https://www.clevelandfed.org/publications/economic-commentary/2010/ec-201002-are-some-prices-in-the-cpi-more-forward-looking-than-others-we-think-so. Accessed January 30, 2024.

7. Referencing data from Federal Reserve Bank of New York, Quarterly Report on Household Debt, as of November 2023.

8. Referencing data from US Bureau of Labor Statistics via FRED; National Bureau of Economic Research; as of December 2023.

9. Referencing data from Bloomberg, as of December 2023.

10. Federal Reserve Bank of San Francisco. “Data Revisions and Pandemic-Era Excess Savings.” SF Fed Blog. https://www.frbsf.org/our-district/about/sf-fed-blog/data-revisions-and-pandemic-era-excess-savings/. Accessed January 30, 2024.

11. Board of Governors of the Federal Reserve System. “Survey of Consumer Finances, 2023.” https://www.federalreserve.gov/publications/files/scf23.pdf. Accessed January 30, 2024.

12. Referencing data from Bloomberg, as of December 2023.

13. Caldara, Dario and Matteo Iacoviello (2022). “Measuring Geopolitical Risk,” International Finance Discussion Papers 1222r1. Washington: Board of Governors of the Federal Reserve System, https://doi.org/10.17016/IFDP.2022.1222r1.

14. Caldara, Dario and Matteo Iacoviello (2022). “Measuring Geopolitical Risk,” International Finance Discussion Papers 1222r1. Washington: Board of Governors of the Federal Reserve System, https://doi.org/10.17016/IFDP.2022.1222r1.

15. Referencing data from the World Bank, as of November 2023.

16. Referencing data from the World Bank and DataBank, as of 2022.

17. Referencing data from the US Census Bureau, US International Trade in Goods and Services (FT900), as of October 2023. Chart covers the fifteen largest sources of US imports.

18. Referencing data from the World Trade Organization, World Trade Report, 2023.

19. US Census Bureau, US International Trade in Goods and Services (FT900), as of October 2023. Chart covers the fifteen largest sources of US imports.

20. Referencing data from the International Monetary Fund, Primary Commodity Prices, as of September 2023.

21. Referencing data from the Food and Agriculture Organization of the United Nations, FAOSTAT, 2021. US Energy Information Administration, Oil and Petroleum Products Explained, October 2, 2023.

22. Referencing data from MSCI Real Capital Analytics, Trend Tracker, as of 28 November 2023.

23. Referencing data from Preqin, as of 29 November 2023.

24. Referencing data from MSCI Real Capital Analytics, Distress Tracker, as of 17 October 2023.

25. Mortgage Bankers Association, Estimated Total Commercial Mortgage Maturities, March 10, 2023.

26. Preqin, as of November 29, 2023.

27. Board of Governors of the Federal Reserve System (US), Senior Loan Officer Opinion Survey (SLOOS), November 2023.

28. Bloomberg, Cushman Senior Mortgage Matrix, as of November 2023.

29. Board of Governors of the Federal Reserve System (US), Senior Loan Officer Opinion Survey (SLOOS), November 2023.

30. Board of Governors of the Federal Reserve System (US), Charge-Off Rate on Credit Card Loans, All Commercial Banks, November 2023.

31. Board of Governors of the Federal Reserve System (US), Charge-Off Rate on Credit Card Loans, All Commercial Banks, November 2023.

32. MSCI Real Capital Analytics, Capital Trends: US Big Picture, August 2023.

33. Bloomberg, Cushman Senior Mortgage Matrix, as of November 2023.

34. Trepp Inc. Based on Federal Reserve Flow of Funds Data, as of Q3 2022.

—