Near-term fundamentals are poised to produce substantial margin expansion in the senior housing sector, presenting an exciting opportunity for investors looking to gain exposure.

The senior housing sector is expected to experience a significant surge in demand over the next decade, driven by the unprecedented acceleration of the 80+ population.

The aging demographic, which is projected to increase by 4.2 million individuals by 2029 as the Silent Generation (people born from 1928 to 1945) and Baby Boomers (people born from 1946 to 1965) enter the prime age range for senior housing (80+ years old).

This powerful demographic wave positions the sector for remarkable growth and indicates an average annual demand of approximately 40,000 units.1 Historical construction starts over the last five and ten years have been approximately 30,000 and ~2,000 units, respectively, representing a 33% increase in unit production needed to meet increasing demand.2

The strong demand for senior housing is already reflected in rising occupancy rates and record-breaking revenue growth for private and public senior housing owners. Furthermore, the scarcity of aging-ready homes suggests that aging in place will be challenging, further bolstering the demand for senior housing. At the same time, with the forecasted growth of the 80+ population extending beyond 2029, the sector shows promising potential for continued demand longer-term. Near-term fundamentals are likely poised to produce substantial margin expansion, presenting an exciting opportunity to gain exposure to the sector.

DEMAND OPPORTUNITY FROM UNPRECEDENTED ACCELERATION OF 80+ POPULATION THROUGH 2029

Senior housing demand fundamentals are strong and are poised to accelerate through the end of the decade, driven by the aging of the Silent Generation and Baby Boomers.

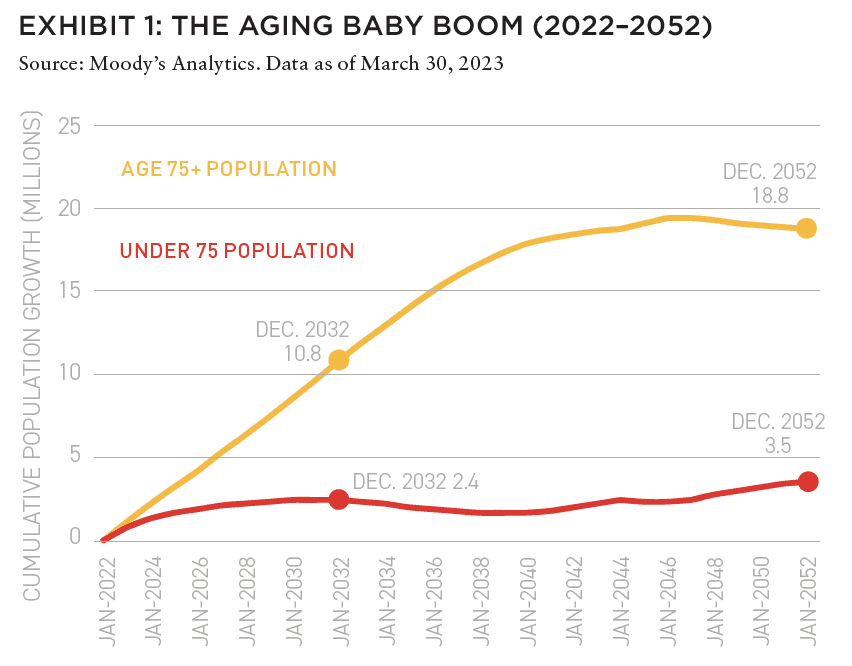

With entry into senior housing communities occurring at the average age of 82, the growth of the 80+ population is a valuable metric to forecast demand trends for the sector. Over the next seven years, the 80+ population is forecast to grow by 4.27 million individuals, from 12.97 million as of 2022 to 17.24 million (approximately 600,000 per year through 2029), as shown in Exhibit 1.3

By comparison, the 80+ population grew by 610,000 individuals from 12.1 million to 12.8 million over the prior seven-year period from 2015 to 2022.4 Based on historical senior housing utilization rates, 4.2 million cumulative population growth among the 80+ population implies average annual demand of roughly 40,000 units annually, equivalent to roughly 325 new communities, through 2029.5

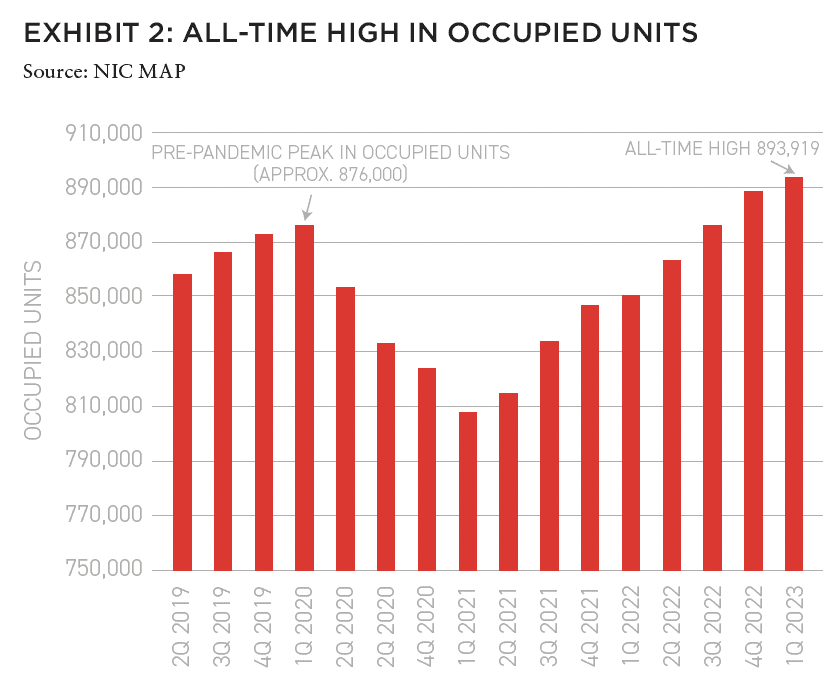

Indeed, in 2022, demand for senior housing units nationally exceeded 42,000, more than any year on record, lifting national occupancy by 2.8% and bringing total occupied units to an all-time high, as shown in Exhibit 2.6

Moreover, strong demand coincided with robust rent growth in senior housing, evidenced by average annual revenue growth of high-single-digit to low double-digit annual revenue growth among public and private operators.

While it is possible that the senior housing utilization rate among the 80+ population will fall in future years, Harrison Street Research indicates such a decline is unlikely given the difficulty for individuals to age in place.

Notably, less than 10% of US homes were aging-ready.7 Beyond 2029, the 80+ population is forecast to grow by another 10.6 million individuals from 2030 to 2050, underscoring the potential for the aging population to provide favorable demand tailwinds well through the end of the decade.8

The short- and intermediate-term operating fundamentals should benefit from low and declining supply activity due to challenging capital market conditions, irrespective of demand drivers.

SUPPLY GROWTH RESTRAINED BY CAPITAL MARKETS, NOT FUNDAMENTALS, BENEFITTING MARGIN GROWTH

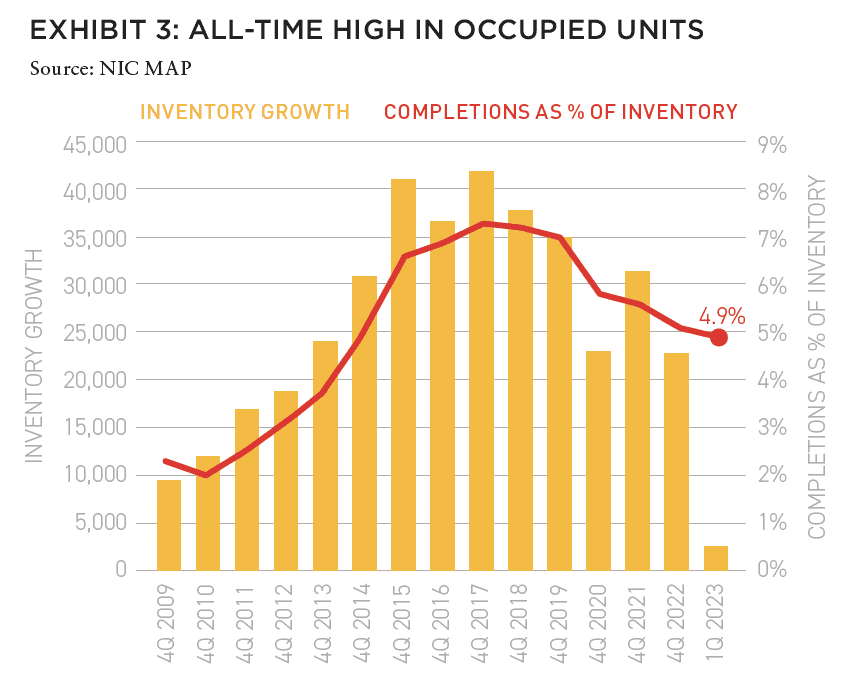

Despite the favorable demand outlook for the sector, senior housing inventory growth slowed significantly since deliveries peaked at 7.3% of existing stock in 2017 to 4.9% as of Q1 2023, as shown in Exhibit 3.

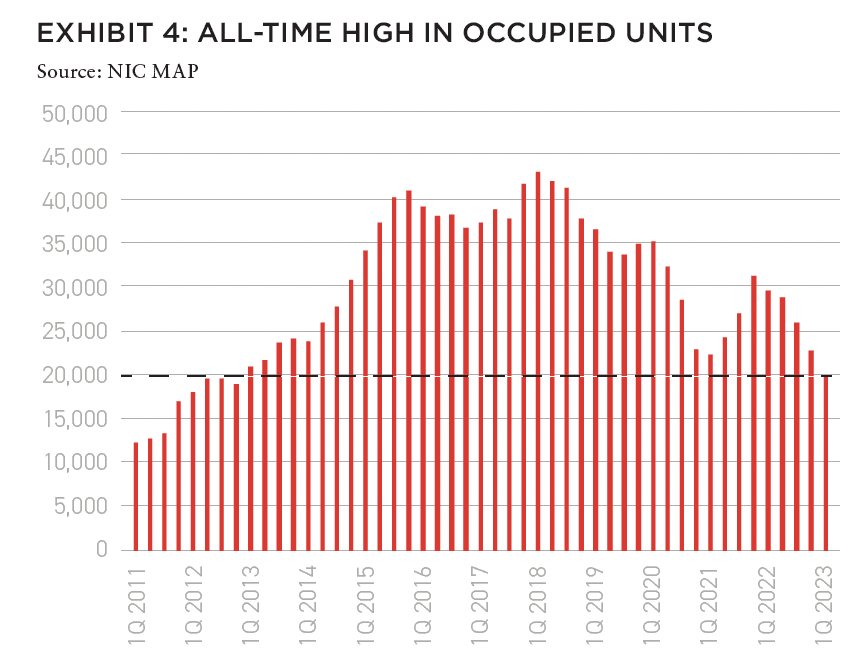

The trend is likely to continue in the short term.9 Because senior housing deliveries typically lag construction starts by roughly two years, changes to the level of construction starts are leading indicators of supply growth. As of Q1 2023, high borrowing costs, elevated goods and services inflation, and volatility in the banking sector contributed to the number of senior housing starts falling to 3,100 units, shown in Exhibit 4, the lowest level since 2012.10 As a result of historically low construction starts and an aging population, Harrison Street believes the supply-demand imbalance within senior housing is poised to favor established, quality operators in the short- to intermediate-term or until the capital market thaws which could ease development challenges.

OPERATING FUNDAMENTALS RESILIENT TO ECONOMIC CONDITIONS

Solid demand and low supply growth amid normalizing labor costs produce enviable operating margin expansion across the industry. For example, in Q1 2023, private market operators and public REITs reported strong occupancy and revenue growth year over year, marking the fifth consecutive quarter of double-digit revenue growth within same-store senior housing operating portfolio.11

Labor costs, which typically range from 55% to 65% of senior housing operating expenses, peaked in the first half of 2022 amid the labor shortage within healthcare broadly, and continued to moderate in Q1 2023, providing relief to senior housing operators. Examples of less temp labor usage can be observed in commentary from various publicly traded companies, including healthcare temp staffing companies, hospitals, senior housing REITs, and Harrison Street’s own portfolio.

Record rental rate growth and slowing labor expense growth are on track to produce enviable same-store net operating margin expansion in 2023. The Green Street 2023 sector outlook research report noted a base case for NOI growth of 19% per year from 2023 through 2025. Public and private market valuations reflect resilient senior housing sector operating fundamentals.12

PUBLIC AND PRIVATE MARKET VALUATIONS REFLECT FUNDAMENTALS

Since the S&P 500 Index bottomed from mid-October through June 2023, the senior housing sector REITs returned 31.5%, compared to 23% for the S&P 500 Index and 7% for the FTSE NAREIT Index.13 According to Green Street, nominal cap rates for senior housing fell 10BPS year-over-year in Q1 2023, the only sector to experience cap rate compression among traditional and alternative real estate sectors in their universe. While senior housing nominal cap rates may widen in 2023, given challenging capital market conditions, Harrison Street believes the sector fundamentals are favorable and should provide downside protection relative to other real estate sectors.

POSITIONED FOR PERFORMANCE

The senior housing sector is experiencing a supply-demand imbalance that favors quality operators in the short- to intermediate-term. While the demand for senior housing is expected to surge, supply growth has been restrained due to challenging capital market conditions. The slowdown in senior housing deliveries and low construction starts underscore the advantage for established operators. Operating fundamentals in the sector remain resilient, driven by solid demand and limited supply growth. Labor costs, a significant expense for senior housing operators, have moderated, providing relief and contributing to enviable operating margin expansion. Record rental rate growth and slowing labor expenses position the sector for impressive net operating margin expansion in 2023. These favorable operating fundamentals are reflected in the strong performance of the senior housing sector in both public and private markets.

IN THIS ISSUE

NOTE FROM THE EDITOR: WELCOME TO #13

Benjamin van Loon | AFIRE

OFFICE TROUBLES: FINANCIAL RISKS AND INVESTING OPPORTUNITIES IN US CRE

Dr Alexis Crow | PwC + Byron Carlock

THE UNDERPERFORMANCE PARADOX: WHY INDIVIDUAL INVESTORS FALL BEHIND DESPITE BUYING LOW

Ron Bekkerman | Cherre + Donal Ward | Tenney 101

CLIMATE THREAT: EXTREME WEATHER IS THE NEW NORMAL FOR REAL ESTATE

Jacques Gordon, PhD | MIT

CLIMATE OPPORTUNITY AWAITS: HOW REAL ESTATE CAN INVEST IN CLIMATE ADAPTATION

Michael Ferrari, PhD and Parag Khanna, PhD | Climate Alpha

PREMIUM PRICE TAGS: INSURABILITY THROUGH PROPERTY RESILIENCE DATA

Bob Geiger | Partner Engineering & Science

REAL ESTATE WEB3: THE EMPEROR’S NEW CLOTHES OR THE NEXT BIG THING?

Zhengzheng Tan, Alice Guo, and Naveem Arunachalam | MIT

ADAPTIVE TO REUSE: COULD BUILDING CONVERSIONS BE DIFFICULT, EXPENSIVE . . . AND STILL PROFITABLE?

Josh Benaim | Aria

RENOVATE, REBRAND, REPOSITION: ADDING VALUE TO MULTIFAMILY THROUGH REVITALIZATION

Robert Kilroy, CFA | The Dermot Company + Will McIntosh, PhD | Affinius Capital

REDEFINING THE PROGRAM: A CONVERSATION WITH ARCHITECT DAVID THEODORE

Peter Grey-Wolf | Wealthcap + David Theodore | McGill University

SENIOR HOUSING UPDATE: EMERGING OPPORTUNITIES THROUGH DEMOGRAPHIC TAILWINDS AND DIMINISHING SUPPLY OUTLOOK

Robb Chapin, Jack Robinson, Andrew Ahmadi, and Morgan Zollinger | Bridge Investment Group

SENIOR HOUSING UPDATE: UNPRECEDENTED DEMOGRAPHIC ACCELERATION MAY DRIVE STRONG OPERATING FUNDAMENTALS AMID ECONOMIC SLOWDOWN

Tom Errath | Harrison Street

HOLIDAY FROM HISTORY: REASONS FOR US OPTIMISM IN A CHANGING GLOBAL ENVIRONMENT

Charlie Smith | Newmark

CRADLE TO CRADLE: AN ALLOCATOR’S VIEW ON IMPLEMENTING ESG INITIATIVES

Christopher Muoio and Katie Cappola | Madison International Realty

FREE LUNCH: MULTI-DIMENSIONAL DIVERSIFICATION IS A FULL-COURSE FREE MEAL

Elchanan Rosenheim and Tali Hadari | Profimex

CAMPAIGN MESSAGING: CFIUS, AFIDA, AND EXPANDING FEDERAL AND STATE RESTRICTIONS ON FOREIGN INVESTMENT IN US REAL ESTATE

Caren Street, John Thoms, and Anya Ram | Squire Patton Boggs

—

ABOUT THE AUTHOR

Tom Errath is Managing Director and Head of Research at Harrison Street, a leading investment management firm exclusively focused on alternative real assets.

—

NOTES

1. The 40,000 annual unit demand projection is based on the pre-pandemic seniors housing utilization rate among the 80+ US population, according to data from NIC MAP

2. NIC MAP

3. Moody’s Analytics

4. Moody’s Analytics

5. Harrison Street Research

6. NIC MAP

7. US Department of Health and Human Services, National Institutes of Health, National Institute on Aging. Aging-ready home is a housing unit with a step-free entryway, a bedroom and full bathroom on the first floor, and at least one-bathroom accessible feature.

8. Moody’s Analytics

9. NIC MAP

10. NIC MAP

11. Welltower corporate financials

12. Corporate financials

13. Bloomberg

—

THIS ISSUE OF SUMMIT JOURNAL IS PROUDLY UNDERWRITTEN BY

For more than 20 years, Yardi has developed real estate investment management software that helps managers of global assets valued at trillions of dollars make informed investment decisions. Yardi Investment Suite clients include many of the world’s premier investment management funds, start-ups and partnerships of all types and sizes.

Real estate investments grow on Yardi. That’s because the Yardi Investment Suite automates complex investment management processes and provides full transparency, from the investor to the asset. Through interactive dashboards, investors can view documents and have access to reports and metrics. Collaboration is easy when your advisor or accountant is given access to view your accounts, reducing the need for emailing sensitive information.

The Yardi Investment Suite leads the real estate industry through innovation and value with fully integrated investment management, property management and accounting functionality. Fund managers and their customers can manage assets with superior efficiency and ease. Learn more.