(This article was originally published by the Observer Research Foundation, and reprinted with permission. View the original at orfonline.org/research/catch-a-falling-r/)

As investors, executives, and policymakers grapple with the effects of multi-decade high inflation, and consider the impact of higher prices on their long-range planning, portfolios, asset prices, and the potential for an economic recession, central banks have come under fire for a perceived failure to maintain price stability.

Amidst the backdrop of an elevated commodity price environment, tight labour markets, demand for both goods and services which continues to surprise to the upside, and persistent supply chain disruptions, some commentators have chided officials at the US Federal Reserve and the European Central Bank (amongst others) for failing to have acted faster to stem the rise in price for labour, goods, and capital. The once reified central bankers—whose “rockstar” status had hitherto been enshrined in elite gatherings—have now been taken to task for their insistence that inflationary pressures were ‘transitory,’ resulting from the shocks to supply and demand from the COVID-19 pandemic. Indeed, the pass through of headline (including volatile food and energy prices) into core inflation (personal consumption expenditures on goods and services) has eroded real incomes, ushering in a “cost of living crisis”1 and the potential for an “inevitable impoverishment”2 for some households.

Although some price pressures appear to have moderated (such as wage inflation in the US3 or the price of some key inputs, such as lumber4), a robust debate has unfolded about the future path of interest rates in the US and other advanced economies. Will the highest inflation in 40 years—and the continued disruption to global commodity markets resulting from the Russia-Ukraine conflict—lead us toward a “higher for longer” interest rate environment? Or, after such crises and shocks eventually subside, will we return to a “lower for longer” interest rate environment, underpinned by aging populations, declining fertility, lackluster economic growth, diminishing returns on innovation, and what one prominent investor has referred to as the “great sag?”5

Part of the answer lies in understanding the future path of r-star—that is, the natural, or equilibrium, rate of interest. In contrast with short-term interest rates (the manipulation of which is a tool of monetary policy), r-star is defined as the natural rate of interest “expected to prevail when the economy is at full strength,” and inflation is stable. Crucially, as NY Federal Reserve President John Williams highlights, r-star is the result of “longer-run structural factors, beyond the control of central banks.”6 These include demographics, productivity growth, innovation, and an increasing preference for holding “safe assets.”7

Thus, a consideration of the future path of r-star involves a number of different interrelated factors, including, but not limited to: productivity, the future of work, and automation; the relationship between labour vs capital, and between innovation and economic growth; indebtedness and fiscal policy; inequality of wages, wealth, pensions, and consumption; a “savings glut of the rich” within domestic economies,8 and global imbalances in net asset positions among economies on a global basis.9 The onus for solutions in each of these arenas falls to fiscal policy as well as to the power of the private sector—and again, such outcomes are not necessarily “determined by central banks.”10

WHY IT MATTERS

Understanding the future of r-star matters for a number of reasons. Crucially, short-term interest rates—and the long-run equilibrium rate—are often conflated by executives and market participants who are constantly bombarded by headlines. In a short to medium term of higher inflation and higher rates (and amidst the attendant hand wringing), the assumption might be to extrapolate from the status quo of short-term rates, which are not necessarily sticky. Thus, for investors, a clear understanding of the long-term trajectory of interest rates is crucial to scoping future rates of return, asset prices, and portfolio allocation. This is especially pertinent for levered businesses such as real estate, infrastructure, and private equity. For executives across the board, a vantage point on the direction of r-star is also critical to scoping the future cost of capital—in other words, in judging how cheap (or expensive) money might be in the longer term.

And for policymakers tasked with maintaining sustainable economic growth amidst aging populations, and the corollary need for expanding entitlements amidst record levels of debt, a clear-eyed discernment of r-star is inherent in fiscal policy and the budgetary outlook. After all, we have only recently exited an era of disinflation, when policy officials and central bankers have cautioned against the economic perils of stagnant growth and of “excessively” low inflation.11

Moreover, in looking beyond advanced economies, the trajectory of r-star in the US is especially important for policymakers, investors, and executives within emerging market and developing economies (EMDEs). An interest rate rise environment in the US might put pressure on local currencies, resulting in imported inflation; as well as stress on USD-levered borrowers; and may potentially spur destabilising capital outflows. Crucially, in the current tightening cycle, central bankers from India have turned a keen eye on the Fed dot plot, as a way of informing RBI policy and, in turn, providing forward guidance to markets and investors.12

Finally, for the private sector as a whole, the interrelationship between falling r-star, expanding wealth-to-GDP ratios, lower returns on assets, and technological unemployment which often disproportionately impacts lower wage workers, the onus is on investors and executives to find ways of mitigating the deleterious effects of a lower r-star on stakeholders and communities, and to incorporate this into their long-term business strategy.

As we shall see, one clear arena where private capital can be mobilized to address public problems relates to R&D and innovation spending in the housing sector.13 As the crisis of affordability in housing ripples across advanced and EMDEs alike, real estate investors—as well as executives from across sectors—can actually spur investments which can boost long-term productivity and growth. As such, taking action and deploying capital to “attack the sources”14 of a falling r-star might constitute a fulfillment of growing ESG mandates—specifically the S or more nebulous social components—which are harder to define in a world focused on climate and energy.

WHAT’S BEHIND THE LONG-RUN DECLINE IN R-STAR IN ADVANCED ECONOMIES? THE SECULAR STAGNATION DEBATE

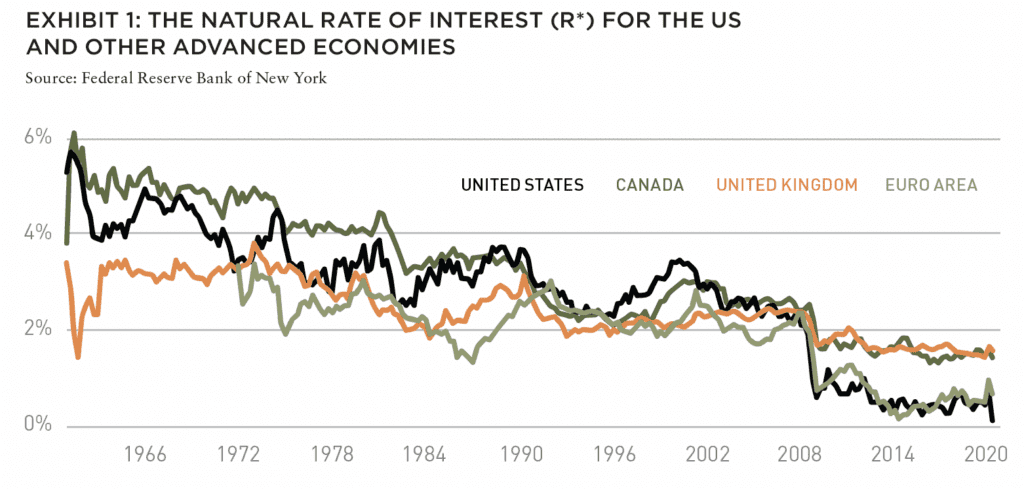

As indicated above, in contrast with short-term interest rates, r-star (or the natural rate of interest) results from longer term macroeconomic and demographic factors. As Holston, Laubach, and Williams find, r-star has been on a long-run decline within OECD economies including the US, Canada, the UK, and the Euro area (Exhibit 1). Researchers at the Bank of Japan point to a similarly low r-star in Japan, hovering around zero percent.15

Demographic factors—including aging populations, and lower birth rates—translate directly into slower trend economic growth, which has contributed to “dramatic declines in the longer-term neutral rate of interest,” or r-star.16 Productivity, too, has been on a downward spiral within many advanced economies.

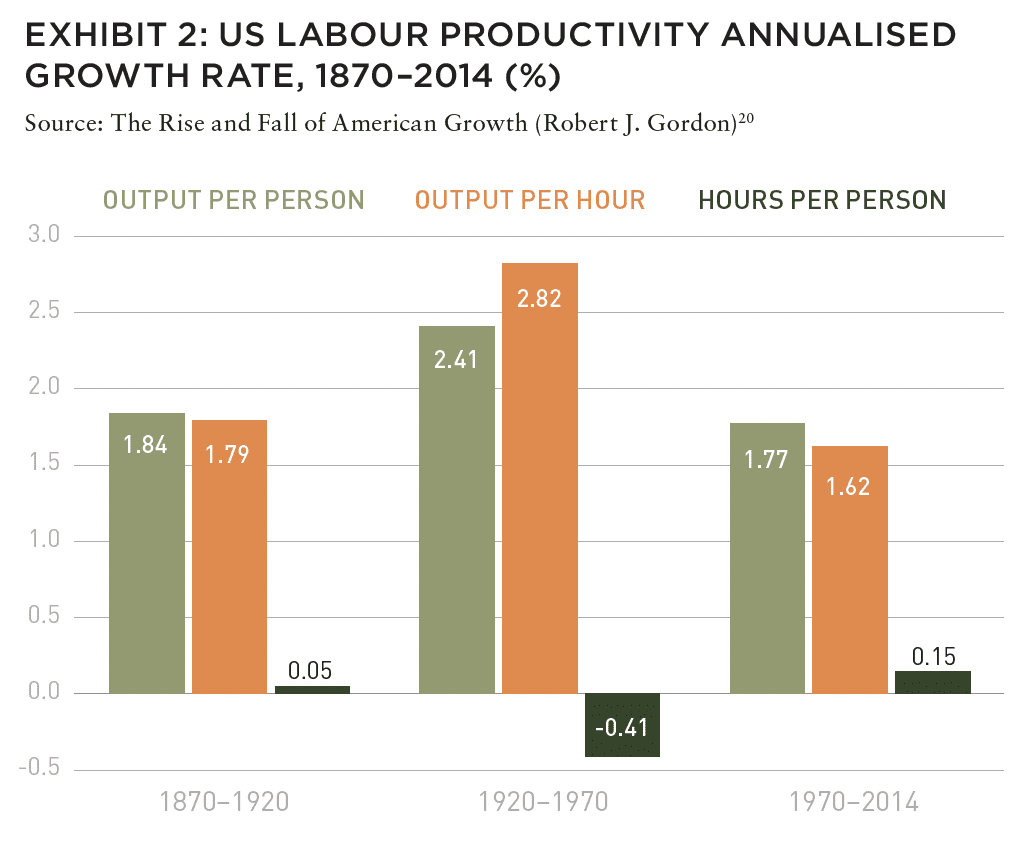

Robert Gordon’s work shows that within the US, productivity grew at a miraculous rate from 1930–70,17 and—with the exception of a brief uptick during the early part of the ICT revolution from 1996–2004,18 and perhaps with gains within some WFH services occupations during the pandemic economy19 – productivity has been on a persistently downward slope. As we see in Exhibit 2, Gordon shows that in America since 1970, workers work more hours, and produce less output.

Part of the reason for initial uptick in the early days of the ICT (information and communications technology) revolution. But decline during the later digital waves might be that the initial introduction of laptop computers and mobile phones supported flexibility in working, and thus enhanced productivity during business travel but that the enhanced digitization which followed—with multiple forms of communication, social media, and indeed gaming21 — have actually distracted workers (and executives) from the task at hand, thus requiring longer to complete a job and to work efficiently.

Moreover, in increasingly consumer-driven economies, less workers means less consumers, which often leads to less growth. In addition, amidst increased longevity, people are planning on longer retirements, and are thus for the most part induced to bolster their savings. All of these reasons—aging populations, declining fertility rates, diminished growth and productivity, and an accumulation of savings—were famously augured by Alvin Hansen in 1938, who neatly summarized such lackluster growth potential as “secular stagnation.”22

EXPLORE THE LATEST ISSUE

MAKE SUSTAINABILITY REAL

With the case for sustainability already well-established, how can (and should) real estate continue to lead?

Gunnar Branson | AFIRE

RETURN GENERATION POTENTIAL

In addition to offering inflation protection and lower volatility, real estate also offers something that other asset classes can’t: the opportunity to invest in tangible, positive change.

Shane Taylor | CBRE Investment Management

CATCH A FALLING *R

The future path of long-term interest rates in the US and why it matters.

Alexis Crow, PhD | PwC

TIDAL PATTERNS

Amidst myriad global economic and geopolitical uncertainties, US commercial real estate has an even greater challenge ahead: demographics.

Martha S. Peyton and Caitlin Ritter | Aegon Asset Management

WORKPLACE VALUES

The sooner we can recognize that values have come down collectively—even beyond the office sector—the sooner we can move forward to capitalizing on new opportunities.

Dags Chen, CFA | Barings Real Estate

OFFICE GAMES

Even as the US office sector has lagged other property types, there could be an important (and valuable) difference of office performance based on property age and market.

William Maher and Scot Bommarito | RCLCO

EMISSION CRITICAL

Workers spending less time in the office post-pandemic may seem negative for the office sector, but a four-day workweek can be a boon for some office property owners.

Kevin Fagan, Xiaodi Li, and Natalie Ambrosio Preudhomme | Moody’s

MOVING TARGETS

A close-in look at twenty major US metros and thousands of properties shows how the overall impact of rising expense loads have narrowed NOI margins. Investors should take note.

Gleb Nechayev, CRE and Webster Hughes, PhD | Berkshire Residential Investments

SAND STATES

In the wake of the Great FinancialCrisis, certain metros in the Sand States suffered disproportionally. It may not be as bad this time.

Stewart Rubin and Dakota Firenze | New York Life Real Estate Investors

STORM WARNING

Not all storms are the same, and some are so tragic that they force a moment of universal recalibration. Hurricane Ian was one of those storms—but what does that mean for real estate?

Rajeev Ranade and Owen Woolcock | Climate Core Capital

PACIFIC THEATER

The Asia-Pacific region is already home to some of the world’s largest economies and now set to lead global economic growth. What’s moving the needle now for the APAC region?

Simon Treacy and Yu Jin Ow | CapitaLand Investment

STABLE SPACE

For e-commerce property investors, the past decade was outstanding, but even as market dynamics are slowing industrial’s momentum, market fundamentals remain sound.

Mehta Randhawa | JLL

WHITHER ANIMAL SPIRITS, AND THE PANDEMIC PRODUCTIVITY BOOM?

Prior to the pandemic, in the wake of the 2017 tax reform in the US and a relative uptick in business investment,23 some executives buoyantly pondered whether we were in a new age of ‘animal spirits’, and that US GDP growth might catapult from a decade plus of slower growth into a new dawn of super powered potential. Consequently, the neutral interest rate—r-star—might rise from the ashes. However, such optimism was “sadly misplaced.”24 Indeed, researchers at the San Francisco Fed25 point to longer term structural drags: namely, that “our increased longevity and propensity to save are the key demographic drivers keeping r-star low, and they’re not about to reverse.”26

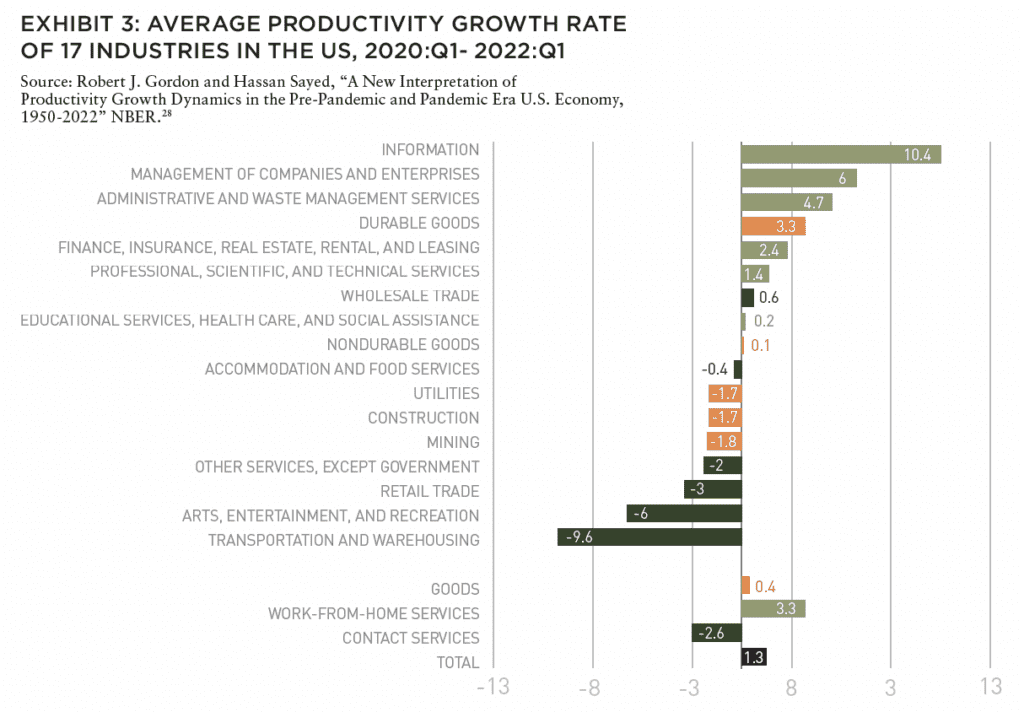

Moreover, the perhaps unprecedented number of changes in labour markets and the production of goods and services has prompted some observers to portend another newer age of high-geared growth (and thus, the potential for a loftier r-star). Recent research shows that productivity gains within the working from home (WFH) services sector during 2020 actually offset the sharp contraction in US GDP during the trough of the COVID-19 induced recession, with a similar effect in six OECD countries.27

Thus, the deployment of “potential capital”—and a capital deepening in technologies to support remote working—demonstrated resilience within the services-oriented sector amidst the sudden economic shock. As we can see in Exhibit 3, the silver lining of productivity gains was sectorally concentrated in IT, management, and business services.

The acceleration of remote working and attendant productivity gains are perhaps reminiscent of the early days or “nine ebullient years,” of the ICT revolution which resulted in sharp productivity gains. Just as the proliferation of laptop computers and mobile p hones ushered in prospects for enhanced productivity, so the transition to WFH—for those fortunate enough to do so—opened up opportunities for virtual communication and collaboration, as well as a deepening of corporate investment in such technologies. (It should also be noted that output gains might also be attributed to the redeployment of hours previously spent commuting to work on the primary job).29

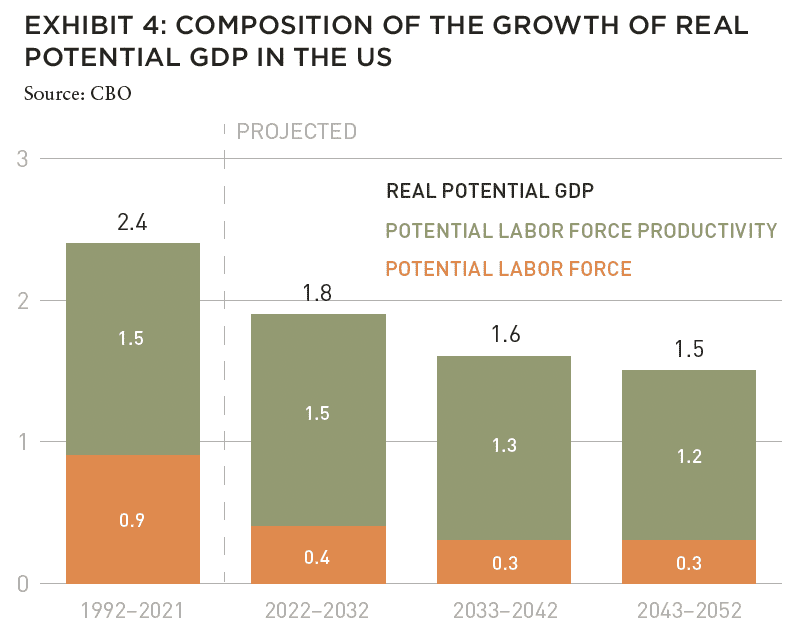

In addition to this pandemic-induced burst of productivity, tight labour markets and trends such as ‘the Great Resignation’ in the US as well as an unremittingly high and volatile commodity price environment, and comparisons to the “bad days” of high inflation of the 1970s some commentators stipulate whether we might be in for a period of stickier or higher for longer interest rates. A simple fact of the matter is that people generally tend to extrapolate from the present moment, and forecast a status quo as an indication of the future. Such a practice is often misleading: despite this confluence of shocks to supply and demand of goods, services, workers, and inputs, persistent structural factors continue to drag on growth within the US and other OECD economies. Indeed, despite the WFH burst of productivity in the initial part of the pandemic economy, the Congressional Budget Office (CBO) forecasts that productivity will decline from 2022 onwards, in tandem with slowing growth of the US labor force.30

AGING, ASSETS, AND GLOBAL IMBALANCES

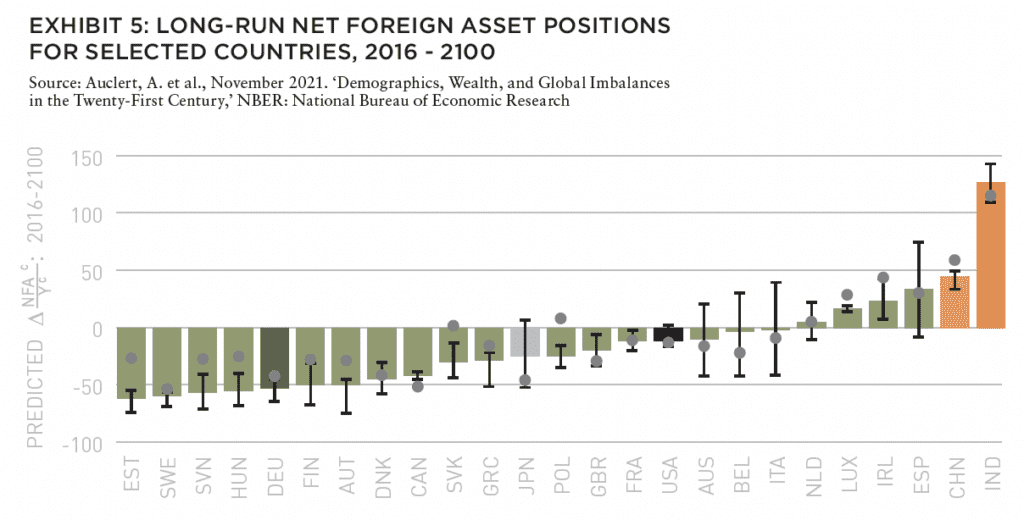

Another structural drag on growth contributing to lower r-star is an expanding imbalance between wealth to GDP. As indicated above, aging populations have an increased propensity to save: thus, over time, labour income gives way to holding assets. In a study of 25 countries—including both advanced and emerging economies—Auclert et al find that wealth to GDP ratios will significantly increase over this century. Such a process leads to “capital deepening everywhere, falling real interest rates,” and “unambiguously implies a falling rate of return.”31

Moreover, as the aging process unfolds at different times within the world’s major economies, this process also results in a corollary imbalance in net asset positions between certain countries (defined as a country’s “excess of wealth over capital and bonds”).32 As we can see in Exhibit 5, by 2100, growing net asset positions in India and China are “financed by declining asset positions in the US.”

Rather than reinforce notions of insecurity concerning China’s rise (as the relationship between China’s assets and America’s debt is a well-researched topic),33 this outlook to the end of the century should actually be illustrative for institutional investors and corporations focused on opportunities for investing in India, especially within financial services.

Beyond the global purview, in considering the outlook for asset prices, one can extrapolate that expanding wealth-to-GDP ratios and lower real rates of return and interest may also result in higher asset prices within some asset classes. This has been the case in commercial and residential real estate in the US and advanced economies since the Global Financial Crisis, set against the backdrop of low to negative interest rates. This dynamic might actually render the acquisition of certain assets—such as housing—out of reach for certain segments of the population, thus amplifying existing wealth inequality, or the gap between the “haves” and the “have-nots.”34 Despite the fact that labour might have temporarily regained the upper hand visa-vis employers in tight labour markets such as the US, ultimately, capital looks likely to prevail, indicating the persistence of the ‘asset economy’ and attendant socio-economic imbalances within countries.35

THE SEARCH FOR SOLUTIONS: INNOVATION IN THE HOUSING SECTOR, AND R-STARS ALIGNED

So what are the solutions?As indicated earlier, r-star results from structural factors beyond the powers of central banks. Thus, the onus for buttressing growth amidst the “great sag” falls upon fiscal and economic policymakers, as well as investors and executives. Which policies might yield the greatest return on investment in R&D, by supporting sustainable economic growth? The passing of the CHIPS and Science Act in the US is salutary, with the potential to support domestic semiconductor production and jobs in technology.36 Japanese Prime Minister Fumio Kishida has also recently designated investing in early stage companies as part of his ‘new capitalism’ agenda, and has tasked a government pension fund with stepping up investments in the venture space.37

Looking at the potential for positive spillover effects from innovation in specific industries, one clear arena where there is hope for change is in the housing sector. A lack of supply of affordable housing continues to exacerbate wealth (and consumption) inequality in the US and other advanced economies. Indeed, the cost of housing in the form of rent continues to erode real incomes across OECD economies. In the US, the finance and insurance (or services) aspects of real estate—as well as personal expenditure on housing—constitute a significant portion of US GDP.38

And yet, an examination of R&D expenditure as a percentage of revenue across sectors reveals that R&D spend for the real estate industry is dead last, far behind pharma and medicine, computer science, and even finance and insurance39 (the latter of which is a sector where perhaps innovations are not always desirable).

Advancements in the PropTech (or property technology) subsector of real estate—and potentially the application of blockchain technology—might actually increase productivity in the leasing and transacting of existing housing stock.40 Additionally, in an opportunity for the private sector and public sector to come together to work toward solutions, land reform and improving land use regulations might actually create greater efficiencies for the construction and retrofitting of housing stock in densely populated urban areas41 – the magnetism of which continues to defy expectations that “cities were dead” in the wake of COVID-19. The opportunities for investing in efficiency gains in the housing sector have not escaped the attention of some of the largest players in the space: over the longer term, the application of technology to streamline leasing and transactions—and the potential to collaborate on land use—might generate long-term returns, as well as bolster ESG criteria for institutional investors and corporations. As shelter is a basic need across the income spectrum, deploying capital to a sector parched for R&D might actually unlock productivity gains, having a positive ripple effect throughout the economy.

Those ripple effects may include efficiency and productivity gains throughout the economy where everyone has shelter as a basic need.

Finally, it is worth pointing out that adopting a clear-eyed perspective on the ‘lower for longer’ trajectory of r-star is not necessarily indicative of a defeatist outlook for the economy. Thus removed from a heady conviction of ‘animal spirits’ and short-term exuberance – which is often latent with anxiety), it is to adopt a sober and necessary understanding of the unfolding of our societies over the long term. In such a way, we can act as stewards for growth, identifying and seizing opportunities to create value and growth in a world otherwise characterized by the great British phrase of ‘muddling through.’

And, as EMDEs eventually confront AE dynamics such as aging populations, flatlining productivity, digitization, wealth inequality, and a crowding into safe haven assets—as those within advanced economies—positive successes born by creative fiscal policy— as well as the direct participation of the private sector—can be shared across borders. Perhaps this will emerge as a rare moment of cohesion on the global economic stage, which has hitherto been marked—perhaps disproportionately—by the coordination of monetary policy and central banks.

—

ABOUT THE AUTHOR

Dr. Alexis Crow leads the Geopolitical Investing practice at PwC, helping leading corporations and asset managers to capitalize on dislocations in order to profit and expand around the globe. She is a guest lecturer at Columbia Business School, and Columbia University’s School of International and Public Affairs (SIPA), and is a Senior Fellow at Columbia Business School, and a Senior Fellow in the Global Business and Economics program at the Atlantic Council.

—

NOTES

1. Zoe Wood, “Majority of Britons cutting back on gas and electricity amid cost of living crisis,” The Guardian, August 5, 2022, https://www.theguardian.com/money/2022/ aug/05/majority-of-britons-cutting-back-on-gas-and-electricity-amid-cost-of-living-crisis

2. Beatrice Madeline, “Inflation : l’inévitable appauvrissement des ménages,” Le Monde, April 8, 2022, https://www.lemonde.fr/economie/article/2022/04/08/inflation-linevitable-appauvrissement-des-menages_6121116_3234.html

3. United States Wages and Salary Growth, Trading Economics, https://tradingeconomics. com/united-states/wage-growth

4. Lumber, Trading Economics, https://tradingeconomics.com/commodity/lumber

5. David Reid, “Ray Dalio says the world is in a ‘great sag’ and echoes the 1930s,” CNBC, October 17, 2019, https://www.cnbc.com/2019/10/17/ray-dalio-says-the-world-is-in-a-great-sag-and-echoes-the-1930s.html

6. John C Williams, “The Future Fortunes of R-star: Are They Really Rising?,” Federal Reserve Bank of San Francisco Economic Letter, May 21, 2018, https://www.frbsf.org/ wp-content/uploads/sites/4/el2018-13.pdf

7. Williams, “The Future Fortunes of R-star: Are They Really Rising?”

8. Atif R Mian, Ludwig Straub and Amir Sufi, “The Savings Glut of the Rich,” National Bureau of Economic Research, April 2020, https://www.nber.org/papers/w26941

9. Ben S Bernanke, “Why are interest rates so low Part 3: The Savings Glut,” Brookings, April 1, 2015, https://www.brookings.edu/blog/ben-bernanke/2015/04/01/why-are-interest-rates-so-low-part-3-the-global-savings-glut/

10. Mark Carney, “Resolving the Climate Paradox: Arthur Burns Memorial Lecture,” September 22, 2016, https://www.bis.org/review/r160926h.pdf

11. See, for example, Carney, “Resolving the Climate Paradox: Arthur Burns Memorial Lecture”; Philip Lane, “Low inflation: macroeconomic risks and the monetary policy stance: Speech at Economic Council workshop,” February 11, 2020, https://www.bis.org/review/r200212b.pdf

12. Anup Roy, “Fed-Style Dot Plot Can Guide India Rates Well, Says Policy Hawk,” Bloomberg, June 27, 2022, https://www.bloomberg.com/news/articles/2022-06-27/ fed-style-dot-plot-can-guide-india-rates-well-says-policy-hawk

13. On the shortfalls of R&D investment in R&D in the US – and the potential gains from innovation in the sector, see: Kung, Edward. ‘Innovation and Entrepreneurship in Housing.’ From Andrews, et al, ed. The Role of Innovation and Entrepreneurship in Economic Growth. NBER. University of Chicago Press: Chicago. 2022. Pgs. 500-501. ‘

14. John C Williams, “If We Fail to Prepare, We Prepare to Fail,” Speech at the 9th High-Level Conference on the International Monetary System on May 14, 2019, https://www.newyorkfed.org/newsevents/speeches/2019/wil190606

15. Shigeaki Fujiwara, et al., “Developments in the Natural Rate of Interest in Japan,” Bank of Japan Review, October 2016, https://www.boj.or.jp/en/research/wps_rev/ rev_2016/data/rev16e12.pdf

16. Williams, “If We Fail to Prepare, We Prepare to Fail”

17. Robert J Gordon, “The turtle’s progress: Secular stagnation meets the headwinds,” Center for Economic Policy Research, August 15, 2014, https://voxeu.org/article/ turtle-s-progress-secular-stagnation-meets-headwinds

18. Referred to as the “ebullient nine years”. See Robert J Gordon and Hassan Sayed, “A New Interpretation of Productivity Growth Dynamics in the Pre-Pandemic and Pandemic Era U.S. Economy, 1950-2022,” National Bureau of Economic Research,” July 2022, https://www.nber.org/papers/w30267

19. Gordon and Sayed, “A New Interpretation of Productivity Growth Dynamics in the Pre-Pandemic and Pandemic Era U.S. Economy, 1950-2022” 20 Gordon, R. J. (2016). The rise and fall of American growth. Princeton University Press. Pg. 14

21. Williams, “The Future Fortunes of R-star: Are They Really Rising?”; Robert J Gordon and Hassan Sayed, “Transatlantic technologies: Why did the ICT revolution fail to boost European productivity growth?,” Center for Economic Policy Research, August 21, 2020, https://cepr.org/voxeu/columns/transatlantic-technologies-why-did-ict-revolution-fail-boost-european-productivity

22. Hansen, cited in Daron Acemoglu and Pascual Restrepo, “Secular Stagnation? The Effect of Aging on Economic Growth in the Age of Automation,” National Bureau of Economic Research, January 2017, https://www.nber.org/papers/w23077

23. Net Domestic Investment: Private: Domestic Business, FRED Economic Data, https://fred.stlouisfed.org/series/W790RC1Q027SBEA

24. Williams, “The Future Fortunes of R-star: Are They Really Rising?”

25. Carvalho, Carlos, Andrea Ferrero, and Fernanda Nechio. 2016. “Demographics and Real Interest Rates: Inspecting the Mechanism.” European Economic Review 88, pp. 208–226.

26. Williams, “The Future Fortunes of R-star: Are They Really Rising?”

27. Janice C Eberly, et al., “’Potential Capital’, Working from Home, and Economic Resilience,” National Bureau of Economic Research, October 2021, https://www.nber. org/system/files/working_papers/w29431/w29431.pdf. These include France, Germany, Italy, Japan, Spain, and the UK. See pg. 10.

28. Gordon and Sayed, “A New Interpretation of Productivity Growth Dynamics in the Pre-Pandemic and Pandemic Era U.S. Economy, 1950-2022”

29. Gordon and Sayed, “A New Interpretation of Productivity Growth Dynamics in the Pre-Pandemic and Pandemic Era U.S. Economy, 1950-2022”

30. It should be noted that a rich debate – beyond the scope of this article – has unfolded as to whether or not the energy transition – as well as forces such pronouncements of “deglobalization”—will continue to unfold as inherently inflationary forces. In the case of the former, Bank of England Governor Andrew Bailey has cautioned that a ‘disorderly’ transition can stoke inflation, as countries, companies, and households rush into the climate resolution. The debates about “slowbalization” or “deglobalization” have also translated into hand-wringing about the inflationary impact of onshoring and protectionism. Although the verdict is out on the degree to which these forces unfold, this author maintains that over the long run, the forces contributing to ‘secular stagnation’ outlined above – and downstream implications of shifting from manufacturing to services-oriented economies, and attendant inequalities – are likely to outweigh the shorter-medium term forces of the energy transition and the rejigging of supply chains, resource ties, and FDI flows which characterize our current trade landscape.

31. Gordon and Sayed, “A New Interpretation of Productivity Growth Dynamics in the Pre- Pandemic and Pandemic Era U.S. Economy, 1950-2022”: Pg. 42; 4.

32. Adrien Auclert, et al., “Demographics, Wealth, and Global Imbalances in the Twenty- First Century,” National Bureau of Economic Research, August 2021, https://www.nber.org/papers/w29161: Pg. 9.

33. See, for example, Bernanke, “Why are interest rates so low Part 3: The Savings Glut”

34. See also: Thomas Piketty and Gabriel Zucman, “Capital is Back: Wealth-Income Ratios in Rich Countries 1700–2010,” The Quarterly Journal of Economics Volume 129, Issue 3, May 21, 2014, https://academic.oup.com/qje/article/129/3/1255/1818714.

35. Lisa Adkins, et al., The Asset Economy, December 2020, https://www.wiley.com/en-us/ The+Asset+Economy-p-9781509543458

36. Sophie Bushwick, “Nearly $53 Billion in Federal Funding Could Revive the U.S. Computer Chip Industry,” Scientific American, August 8, 2022, https://www. scientificamerican.com/article/nearly-53-billion-in-federal-funding-could-revivetheu- s-computer-chip-industry/

37. Antoni Slodkowski and Eri Sugiura, “Japan to Tap Vast Pension Fund in Drive to Create More Start-ups,” Financial Times, June 10, 2022, https://www.ft.com/content/ c8d88d08-ff3c-43f2-af43-e7ea6642d865

38. Edward Kung, “Innovation and Entrepreneurship in Housing,” in Andrews, et al, ed. The Role of Innovation and Entrepreneurship in Economic Growth. NBER. University of Chicago Press: Chicago. 2022. Pgs. 500-501.

39. Kung, “Innovation and Entrepreneurship in Housing”: Pg. 505.

40. Kung, “Innovation and Entrepreneurship in Housing”: Pg. 528.

41. Kung, “Innovation and Entrepreneurship in Housing”: Pg. 528.

THIS ISSUE OF SUMMIT JOURNAL IS PROUDLY SUPPORTED BY

Our focus on delivering results is driven by our values, entrepreneurial spirit and our clients’ diverse needs. Together, our team specializes in holistic real assets solutions within and across five real assets investment categories, with a distinct approach to driving performance and long-term value.

CBRE Investment Management is a leading global real assets investment management firm with $143.9 billion in assets under management as of September 30, 2022, operating in more than 30 offices and 20 countries around the world. Through its investor-operator culture, the firm seeks to deliver sustainable investment solutions across real assets categories, geographies, risk profiles and execution formats so that its clients, people and communities thrive.

CBRE Investment Management is an independently operated affiliate of CBRE Group, Inc. (NYSE:CBRE), the world’s largest commercial real estate services and investment firm (based on 2021 revenue). CBRE has more than 105,000 employees (excluding Turner & Townsend employees) serving clients in more than 100 countries. CBRE Investment Management harnesses CBRE’s data and market insights, investment sourcing and other resources for the benefit of its clients. For more information, please visit cbreim.com.