In these post-COVID times of moderate economic growth and tighter monetary policies globally, the world could see a bigger wave of progression for the Asia-Pacific region (APAC).

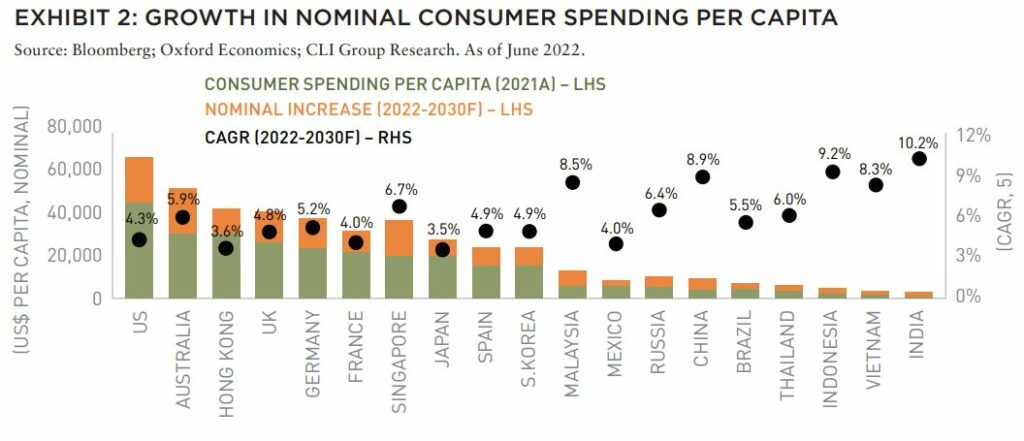

Emerging Asian countries are blazing the trail in global urbanization, on the back of the outsized scale of rural-urban migration. At the same time, consumer spending growth is forecast to be strongest globally in the emerging markets of China, India, and Southeast Asia into the next decade.

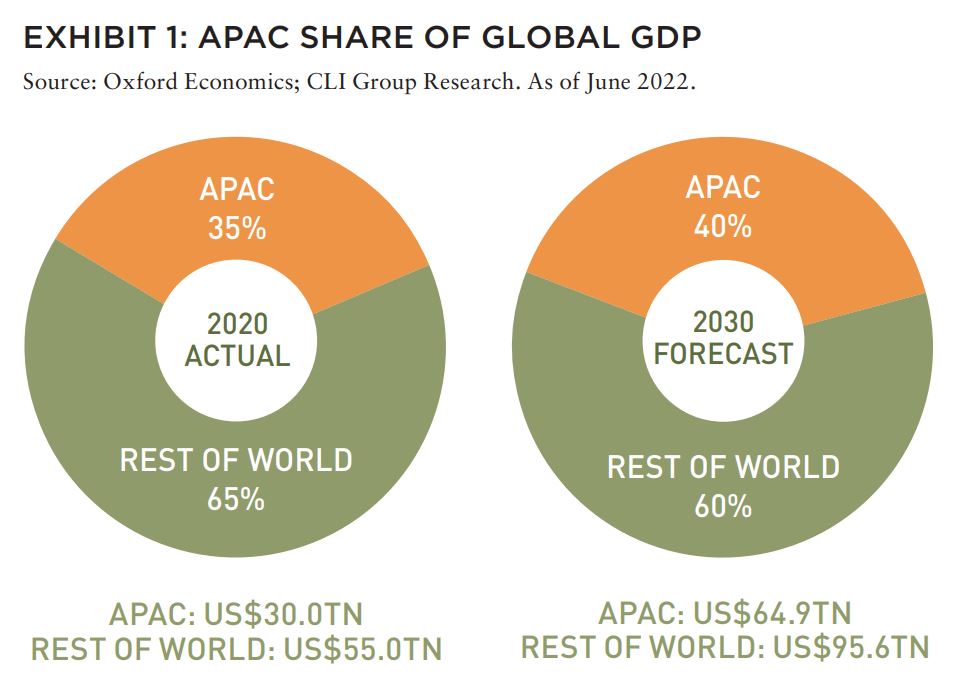

APAC has been the leading region through all economic downcycles over the last two decades, proving its economic resilience, and is set to continue this positive trajectory towards achieving robust economic gains in the next few years, with the region projected to contribute more than 40% of global GDP by 2030.

There are three key themes for investors to note:

- APAC tailwinds could mitigate global headwinds

- Divergence in monetary policies between the East and West

- Property returns exhibit more nuances at the country and sector level

APAC TAILWINDS AND GLOBAL HEADWINDS

The global economy is facing one of the most challenging periods in several decades, with considerable headwinds stemming from a myriad of events, including geopolitical conflicts, the COVID-19 pandemic, supply-chain disruptions, decade-high inflation, and accelerated tightening of monetary policies.

The competitive advantages of APAC place the region in a strategic position as an attractive investment destination to institutional investors for the long term and should serve to limit any potential downside from the uncertainties in the global environment. Positive macro fundamentals and favorable secular trends are likely to continue to drive incremental demand for quality real estate products, underpinned by:

- APAC’s dominance in global economic growth, led by China, India, and Southeast Asia: Growth in APAC is expected to average 4.4% through 2022-26, and to considerably outpace the global (3.1%), US (2.2%) and Eurozone (2.1%) averages.1

- Australia (3.2%) and Singapore (2.8%) are forecast to be among the fastest growing developed economies, while half of the top ten largest economies globally will be in APAC over the next decade.

APAC has emerged as the leading region through all economic downcycles since 2000, including the dot-com bust, the Global Financial Crisis and the height of the COVID outbreak in 2020. The region is increasingly more dominant and will make up 40% of global GDP by 2030, up from 28% and 35% in 2010 and 2020, respectively (Exhibit 1). The investible real estate universe in the APAC region will grow2 in tandem with the sustained robust growth of its economy, with a further boost from its incremental market share of the global economy.

Emerging APAC countries— namely, China (16.6 million annual increase in urban population), India (9.7 million increase), and Indonesia (3.5 million increase)—are expected to lead the rise in urbanization rates globally into the next decade.3 The sheer scale of rural-urban migration in these countries will present an outsized potential demand pool for real estate and infrastructure products.

Rapid expansion4 of the tertiary sector of major economies in APAC considerably outpaced their US and European counterparts over the last decade and this trend is expected to persist. Annual services sector growth through 2022–30 is projected to be the strongest in India (8.1%) and China (5.3%).5 Australia (3.6%) and Singapore (2.9%) are projected to lead developed countries globally through the same period, compared to the US (2.2%), UK (2.1%), and Germany (1.4%).

On a per-capita basis, consumer spending growth rates over 2022–30 are forecast to be strongest in the emerging markets of China, India and Southeast Asia, underpinned by favorable demographics and rapid urbanization (Exhibit 2). Australia and Singapore are projected to lead growth among the developed markets, in part driven by sustained healthy economic growth, as well as stable and tight employment market.

Moreover, there are several additional structural trends which we believe will contribute to the underlying strength and attractiveness of the real estate sector in APAC over the next few years, including(1) sustained infrastructure spending and improvements; (2) rise of environmental, social, and governance (ESG) standardization; (3) digitalization and automation; and (4) demand-supply mismatch due to elevated flight-to-quality requirements.

MONETARY POLICY: EAST VS. WEST

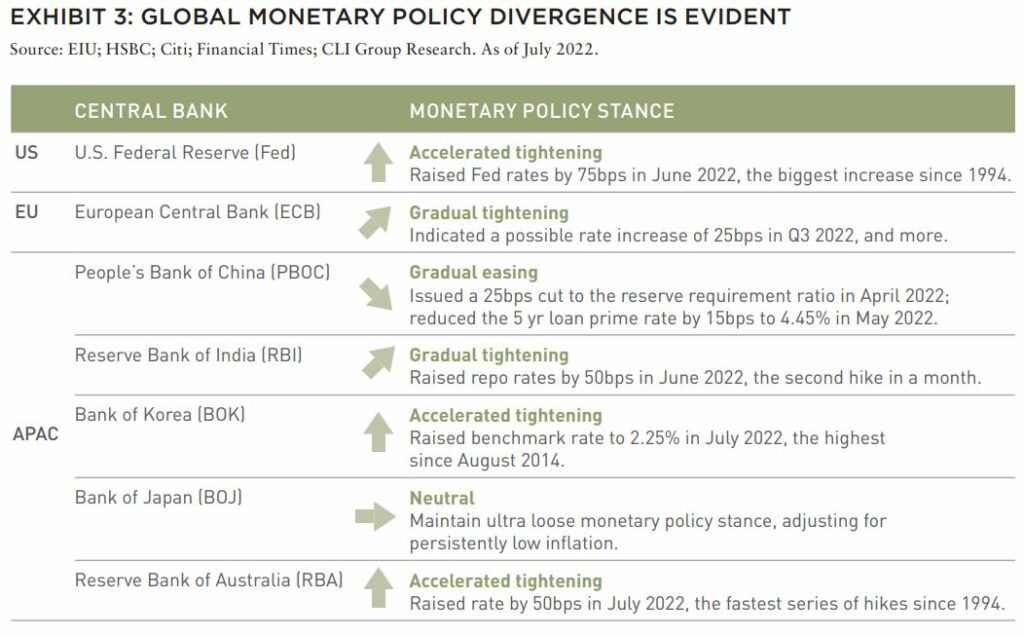

Inflation is at multi-decade highs in the US and the Eurozone, but relatively benign in parts of Asia (i.e., China and Japan). Inflationary pressures, however, are more prevalent in select higher growth developed countries (e.g., Singapore and Australia), albeit still at comparatively manageable levels.

Widening divergence in monetary policies globally is increasingly evident, as central banks move to deal with the incessantly high inflation. There is a noteworthy degree to which monetary policies may be out of sync in parts of APAC with the rest of the global economy (Exhibit 3) and the dispersion can offer interesting and attractive risk adjusted investment opportunities in the region.

PROPERTY RETURN NUANCES AT THE COUNTRY AND SECTOR LEVEL

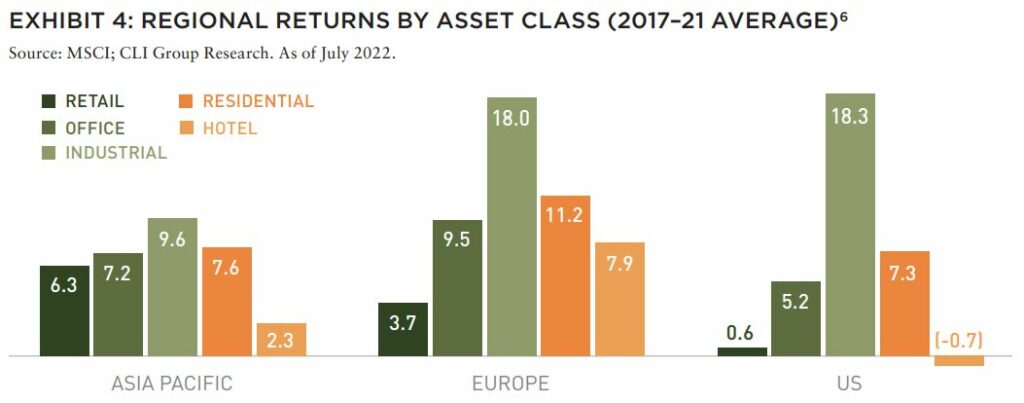

While there is some fluctuation in total returns across all regions in the various historical time frames, owing to uneven capital returns, income returns have been largely stable and at similar levels for each region (at 4–5%). The total returns profile however is more distinct at the asset class level (Exhibit 4).

Within APAC, the shift in market-specific drivers and fundamentals can be evidenced by the dynamic shift in total returns by country and sector year to year. Diving deeper, property returns at the country, sector and city level further lend to the notion that property market fundamentals across APAC are highly diverse and disparate, and this will remain a key feature of the region going forward.

DEEPER INSIGHTS ARE ESSENTIAL IN THE HIGHLY DIVERSE APAC REGION

The property sector in the APAC region has evolved considerably over the last decade and is becoming progressively more institutionalized. This is clearly evidenced by the increased market liquidity, with total commercial real estate transaction volume in the APAC region having exceeded US$200 billion for the first time in 2021.7

Notably, institutional investor interest in new economy assets has accelerated in recent years, with total transaction volumes having more than tripled over the last five years, reaching US$37 billion (+22% YoY) in 2021, while the deal count has also more than doubled over the same period.8 While the APAC region is likely to see keener investor interest going forward, the highly distinct real estate markets in the region are by and large complicated to navigate. Deeper insights are essential in market selection and assessing new opportunities.

As in other highly specific global regions, an intimate knowledge of local markets and execution capabilities is often the key determinant of success, due to the varied demand drivers and underlying real estate fundamentals across the region characterized by:

Marked heterogeneity in the property cycle: Positions of major APAC countries vary considerably across the space and capital market cycles. Deep understanding of local real estate dynamics and operating capabilities are essential to unlock potential investment returns.

Wide spectrum of investment opportunities: The diversity within investable markets across the region offers a broad selection of available investment options to cater to varying degrees of investor risk appetite.

Investing into real estate across the region over the next few years, against a backdrop of evolving government policies, rising interest rates, elevated asset pricing, escalating construction costs, and other factors is likely to be increasingly challenging. However, new opportunities with attractive risk-adjusted returns will typically also emerge during these periods, in part driven by the cyclical rebound, credit market gaps and pricing dislocations (e.g., special situations, distressed situations, and credit opportunities in China).9

These unprecedented times present both challenges and opportunities and will require institutional investors to make conscious investment decisions to rebalance and better futureproof their real estate portfolios. APAC’s indubitable continued growth story makes a well-grounded investment case, and this is an opportune time for investors to gain or increase exposure to the region.

EXPLORE THE LATEST ISSUE

MAKE SUSTAINABILITY REAL

With the case for sustainability already well-established, how can (and should) real estate continue to lead?

Gunnar Branson | AFIRE

RETURN GENERATION POTENTIAL

In addition to offering inflation protection and lower volatility, real estate also offers something that other asset classes can’t: the opportunity to invest in tangible, positive change.

Shane Taylor | CBRE Investment Management

CATCH A FALLING *R

The future path of long-term interest rates in the US and why it matters.

Alexis Crow, PhD | PwC

TIDAL PATTERNS

Amidst myriad global economic and geopolitical uncertainties, US commercial real estate has an even greater challenge ahead: demographics.

Martha S. Peyton and Caitlin Ritter | Aegon Asset Management

WORKPLACE VALUES

The sooner we can recognize that values have come down collectively—even beyond the office sector—the sooner we can move forward to capitalizing on new opportunities.

Dags Chen, CFA | Barings Real Estate

OFFICE GAMES

Even as the US office sector has lagged other property types, there could be an important (and valuable) difference of office performance based on property age and market.

William Maher and Scot Bommarito | RCLCO

EMISSION CRITICAL

Workers spending less time in the office post-pandemic may seem negative for the office sector, but a four-day workweek can be a boon for some office property owners.

Kevin Fagan, Xiaodi Li, and Natalie Ambrosio Preudhomme | Moody’s

MOVING TARGETS

A close-in look at twenty major US metros and thousands of properties shows how the overall impact of rising expense loads have narrowed NOI margins. Investors should take note.

Gleb Nechayev, CRE and Webster Hughes, PhD | Berkshire Residential Investments

SAND STATES

In the wake of the Great FinancialCrisis, certain metros in the Sand States suffered disproportionally. It may not be as bad this time.

Stewart Rubin and Dakota Firenze | New York Life Real Estate Investors

STORM WARNING

Not all storms are the same, and some are so tragic that they force a moment of universal recalibration. Hurricane Ian was one of those storms—but what does that mean for real estate?

Rajeev Ranade and Owen Woolcock | Climate Core Capital

PACIFIC THEATER

The Asia-Pacific region is already home to some of the world’s largest economies and now set to lead global economic growth. What’s moving the needle now for the APAC region?

Simon Treacy and Yu Jin Ow | CapitaLand Investment

STABLE SPACE

For e-commerce property investors, the past decade was outstanding, but even as market dynamics are slowing industrial’s momentum, market fundamentals remain sound.

Mehta Randhawa | JLL

—

ABOUT THE AUTHORS

Simon Treacy is CEO of Private Equity Real Estate and Yu Jin Ow is Vice President of Group Strategy and Research for CapitaLand Investments, a leading Asian real estate investment manager with a global foothold.

—

NOTES

1. Projections by Oxford Economics as of June 2022.

2. The real estate market size of APAC tracked by MSCI was recorded at around US$630 billion as of 2020, up from around US$386 billion in 2010. The coverage ratio for APAC was around 22% based on the estimated total market size of US$2.8 trillion in 2020. Source: MSCI, May 2022.

3. Projections by World Bank and Oxford Economics as of February 2022.

4. Includes tertiary sectors such as banking & finance, professional services, information technology, retail trade, healthcare, etc.

5. Projections by Oxford Economics as of June 2022.

6. Total returns in US Dollars.

7. Figure excludes development sites. Source: Real Capital Analytics, May 2022.

8. Includes business parks, data centers, logistics, tech parks, etc.

9. See also: Tze Shyang, Puah, and Yu Jin, Ow. “China’s Deleveraging Platform: Opportunities Ripe for Select Picking.” CapitaLand, June 2022. https://www.capitaland. com/en/about-capitaland/newsroom/inside/2022/jun/.

—

REVIEWER RESPONSE

Overall, the authors present an inviting rationale for real estate investment in APAC. Economic tailwinds in the region are a counterbalance for international investors mired in investments in low-growth markets. Economic growth, coupled with tremendous urbanization, will fuel demand for new real estate. Investing on the front end of this trend captures growth, all the while participating in an increasingly institutional and investable market. And lastly, this is all supported by continued national spend on infrastructure, the rise of ESG standardization, automation, and demand for new generation space.

While the macro story is logical, and one might quibble with certain propositions (hasn’t Asia always operated in a higher infl ationary environment?), for me the crux of the rationale is why “deeper insights are essential” (i.e., it all comes down to the real estate). Here the authors introduce the complexity and nuance of investing in different sectors across geographies, but to a certain degree, leave the reader wanting for more. Of course, “deep understanding of local real estate . . . [is] essential to unlock potential real estate returns,” but what are examples in APAC? Given the nature of the article, the authors are absolved from going into too much detail. They do deliver the point that the investing in APAC is complex and that there are a range of investment options cater to varying degrees of investor risk appetite. To this end, they nicely set the stage on why APAC should be on the investment menu and are inviting you for a more in-depth conversation about what you can order.

Thomas Brown

Partner, LGT Capital

Member, Summit Journal Editorial Board

THIS ISSUE OF SUMMIT JOURNAL IS PROUDLY SUPPORTED BY

Our focus on delivering results is driven by our values, entrepreneurial spirit and our clients’ diverse needs. Together, our team specializes in holistic real assets solutions within and across five real assets investment categories, with a distinct approach to driving performance and long-term value.

CBRE Investment Management is a leading global real assets investment management firm with $143.9 billion in assets under management as of September 30, 2022, operating in more than 30 offices and 20 countries around the world. Through its investor-operator culture, the firm seeks to deliver sustainable investment solutions across real assets categories, geographies, risk profiles and execution formats so that its clients, people and communities thrive.

CBRE Investment Management is an independently operated affiliate of CBRE Group, Inc. (NYSE:CBRE), the world’s largest commercial real estate services and investment firm (based on 2021 revenue). CBRE has more than 105,000 employees (excluding Turner & Townsend employees) serving clients in more than 100 countries. CBRE Investment Management harnesses CBRE’s data and market insights, investment sourcing and other resources for the benefit of its clients. For more information, please visit cbreim.com.