Will increased state and local tax intake in major markets be unhealthy for real estate portfolios?

Will increased state and local tax intake in major markets be unhealthy for real estate portfolios?

Liquidity and risk are difficult to separate, as there is a strong correlation between markets that institutional investors view as liquid and those they perceive as low risk.

Although created to incentivize investments Qualified Opportunity Zone, if structured appropriately, non-US persons can find a path to the emerald city.

With the US macro economy and commercial real estate cycles generally viewed as nearing a down cycle, the need to tap diversification benefits from real estate may soon be at hand. Should you worry?

Seattle, Washington – home to some of the most innovative companies in the world – provided a meaningful forum for exploring the promises and perils of change.

Real estate is often considered a “local” business, but to succeed real estate professionals need to understand what’s happening around the globe.

AFIRE’s Rising Leaders recently gathered in New York to talk about what it means to face fear and grow through the challenges of change in commercial real estate.

The era of ESG as the authoritative measure of “sustainability” or “non-financial” performance has arrived

Commercial real estate investors are familiar with the eternal motto: “location, location, location,” but for a new generation, we should say, “demographics first”

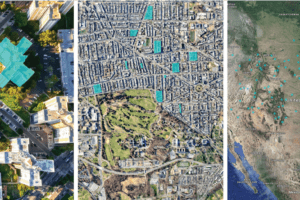

Savvy investors are acutely aware that many fundamental measures of the US real estate market vary widely depending on the metro area

When it comes to comps, using immediate location as an exclusive reference base for analysis can obscure bigger-picture truths

Multi-national capital and US cap rate compression is driven by the same force

Managers who can’t efficiently gather data and who don’t know how to effectively put it to work will struggle to capture investment allocations

The 2019 AFIRE Winter Conference explored the various types of understanding needed to move beyond fear

Enter your email address and password associated with your membership to log into AFIRE.org. If you are unable to login through this popup, go to https://members.afire.org to reset your password. For questions, contact us.